Advisors understand the weight of investing as an experience. Crafting a bespoke investing journey isn't just about numbers. It's about fostering deep client connections that last a lifetime and ensuring clients truly resonate with a collaborative investment journey.

Enter Seeds Investor. Our latest partner joining the Altruist Model Marketplace. Seeds Investor gives investments depth, purpose, and a personal touch. Now, with the combined might of both platforms, advisors are positioned to elevate their businesses: merging personalized portfolio construction with automation at scale.

For those unfamiliar with Seeds Investor, envision a platform that transforms investing from a mere process into a personalized experience. Client expectations are constantly evolving and with Seeds Investor, advisors can stay ahead–comprehending the investor’s psyche and aligning their investment strategies with what truly resonates with the client.

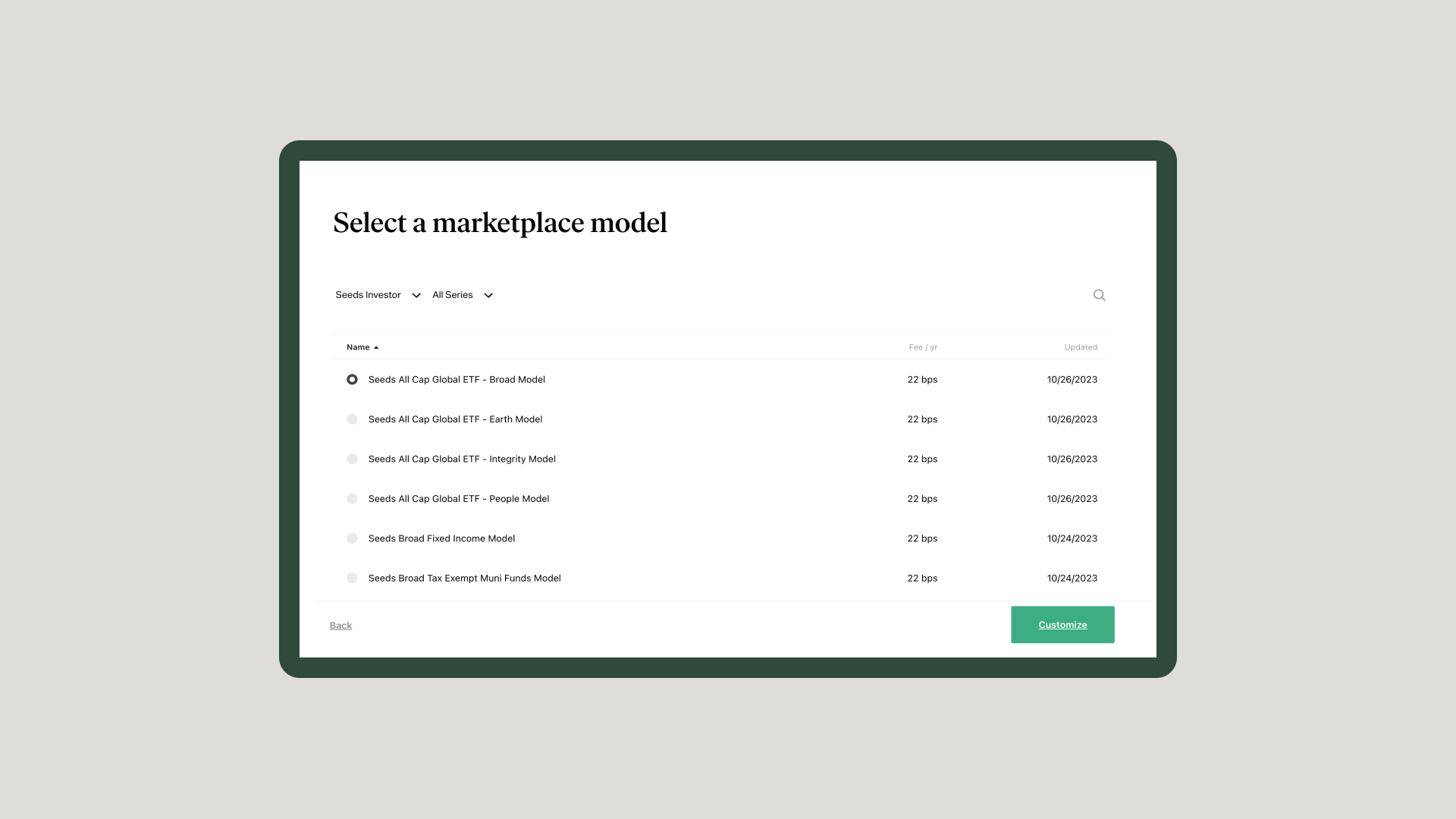

Their investment solutions provide a comprehensive, multi-asset class portfolio, ensuring customization around each client's unique needs. Seeds offer access to different single-stock portfolios across US large, mid, and small-cap, as well as international-only exposures. Advisors can also toggle between values-aligned or values-agnostic options–depending on the client’s preferences. ETF options are available as well, instead of single security exposure. For fixed income, Seeds also presents both taxable and municipal bond exposures, allowing values alignment.

Assess, draft, and propose on Seeds; Build and execute on Altruist

Here’s how the partnership works:

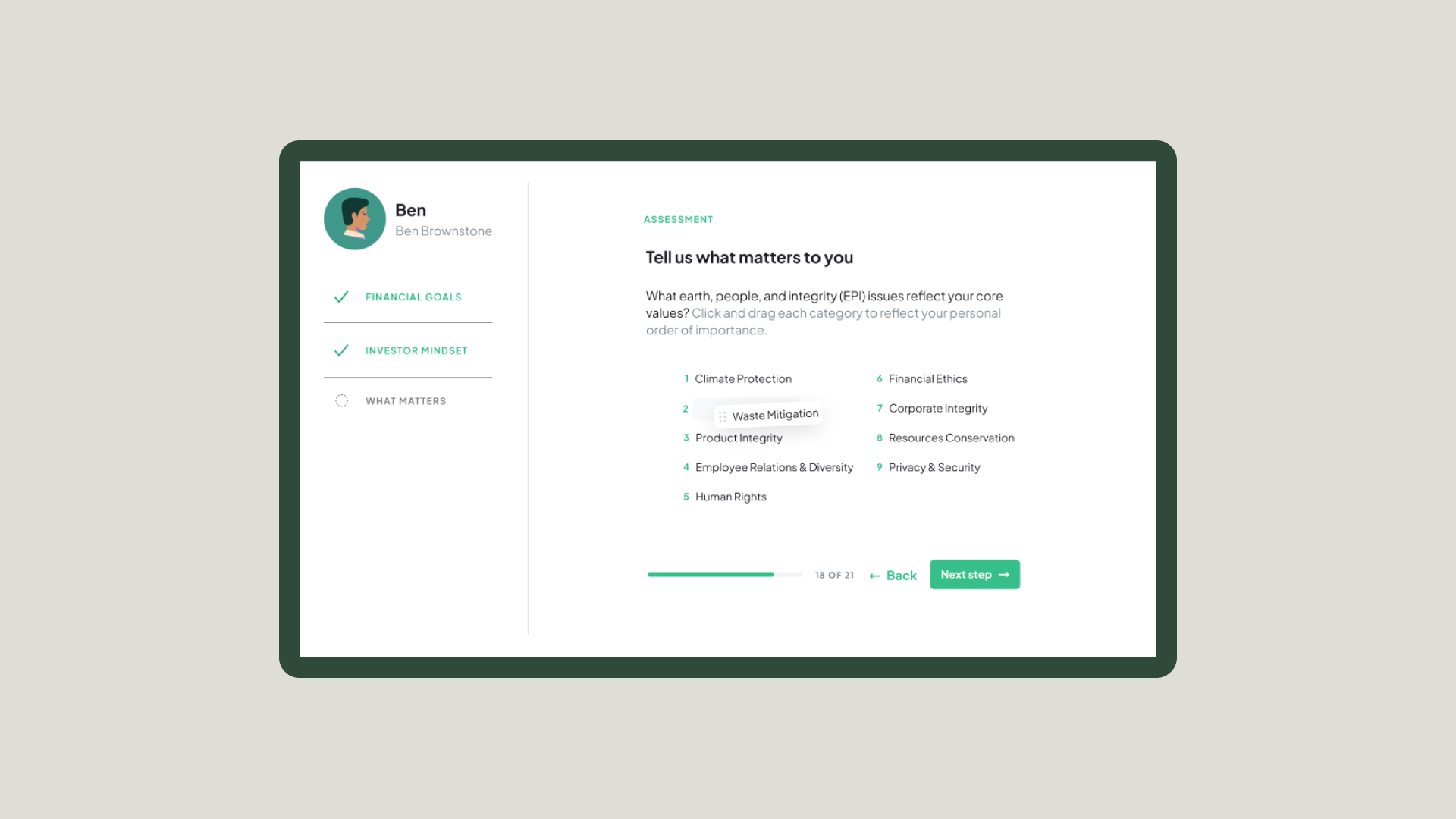

Step 1: Begin with Seeds. Take the 20-question assessment: an insightful diagnostic framework that goes beyond traditional parameters like risk tolerance. With the Seeds platform, understand what genuinely matters to your clients.

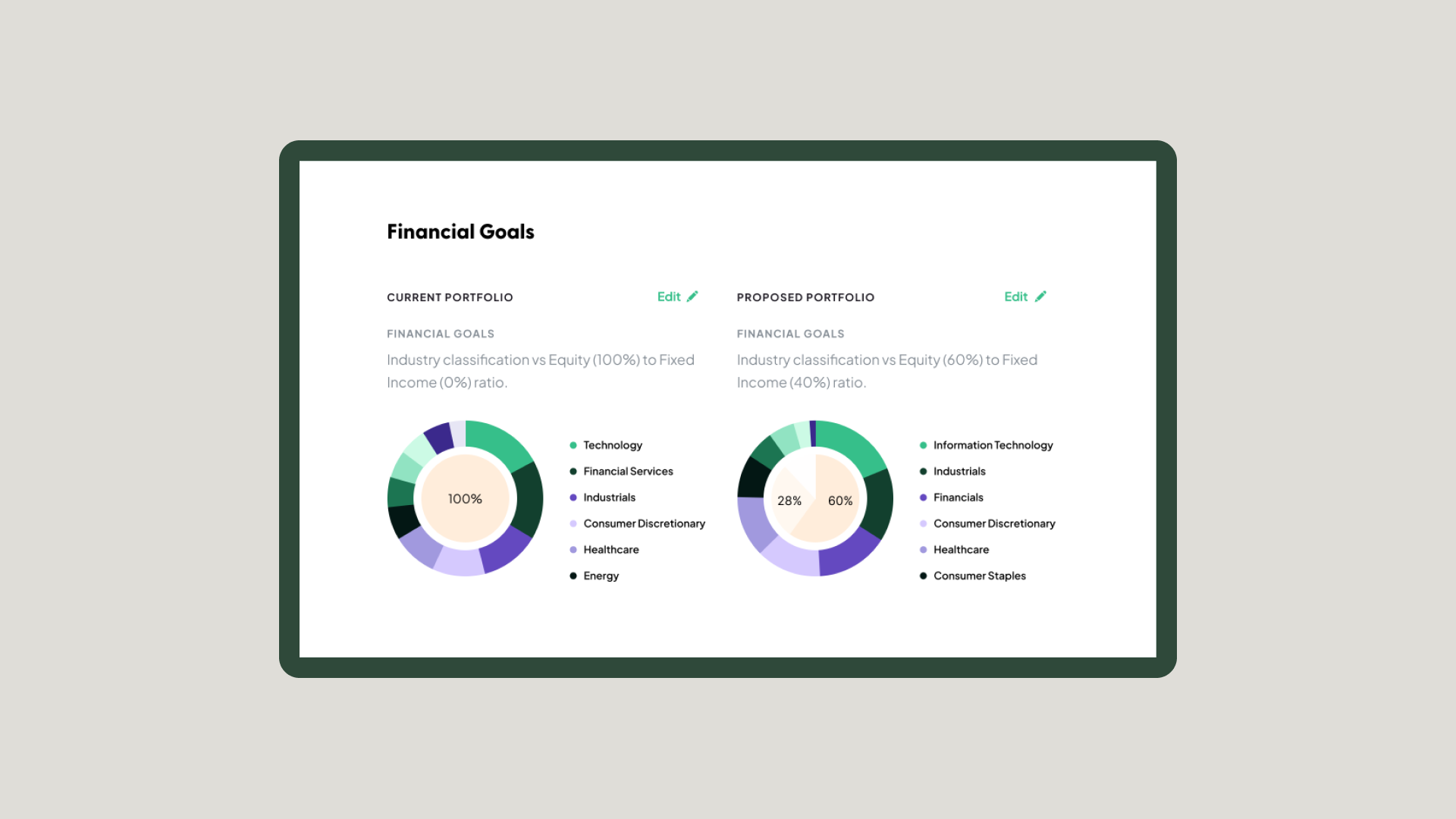

Step 2: Seeds, with its cutting-edge algorithms, will offer a recommended portfolio that aligns with your client's preferences, values, and financial aspirations.

Step 3: Move on to Altruist to bring these visions to life. Craft, refine, and execute the proposed portfolio strategies on the Altruist Model Marketplace.

Creating solid outcomes for both advisors and clients

This partnership empowers advisors to bridge clients' values with their financial objectives, driving more meaningful, outcomes-focused investment strategies. Consider leveraging the partnership if you have clients who:

- Are seeking to make an impact with their investing. Some investors aren't just looking for returns. They want to understand the broader implications of their portfolios and invest in what matters most to them.

- Are seeking to be a more informed investor. With access to detailed, bespoke insights and tailored reports, advisors are better equipped to guide investors in making decisions that resonate deeply with their personal and financial aspirations.

Join us in conversation

We invite you to sign up for our live webinar scheduled for November 15th. Zach Conway, the Founder and CEO of Seeds Investor, will shed more light on how Seeds, in partnership with Altruist, empowers advisors to make investing more meaningful, intentional, and personal.