Tax management plays a critical role in long-term investment performance, second only to an investor’s behavioral tendencies. Research suggests that holistic tax management strategies can enhance after-tax performance by 1-2% annually (Bouchey, 2016; WSJ, 2021; Vanguard, 2022).1

These insights inspired the creation of Altruist’s TaxIQ, a comprehensive suite of tools designed to optimize tax efficiency in client portfolios through strategies like tax loss harvesting and tax-sensitive rebalancing.

We developed the first version of our tax loss harvesting (TLH) feature to help advisors deliver meaningful tax savings to clients at scale. Today, its newest enhancements—a daily tax loss harvesting scan, capital gains budgeting capabilities, and gain/loss summaries—make it even more powerful and user-friendly.

How tax-loss harvesting works at Altruist

Altruist’s original tax-loss harvesting feature takes action anytime a rebalance is triggered on a client’s portfolio—which can happen as a result of event-based or drift-based settings.

When a rebalance is triggered, our system combs through each tax lot in the portfolio and seeks potential harvesting opportunities from unrealized losses. The decision to sell a position is based on factors including:

- The size of the loss

- How volatile the security is

- The time of the year (small losses may be opportunistically realized in December even if they otherwise wouldn’t have been earlier in the year)

- The duration that the security was held for (certain short-term losses may be realized to offset other higher-taxed short-term gains).

- The impact of the sale on dispersion

The proceeds from tax-loss harvesting are used to invest in similar or underweighted positions in the portfolio.

Our new daily scan option

We’ve enhanced our existing Tax Loss Harvesting feature by introducing daily scan capabilities.

Daily Scan allows accounts using our automated rebalancer to take advantage of beneficial opportunities to use realized losses to produce a tax benefit or decrease dispersion that arise on days when there would otherwise be no impetus to rebalance. This allows your accounts to be much more responsive to market movement, helping to maximize the benefits delivered by tax loss harvesting.

The Tax Loss Harvesting (TLH) feature alone will only rebalance when its event- or drift-based rebalance criteria are met. This means that you may miss out on opportunities to create a tax benefit or utilize realized losses to reduce dispersion on days when an account either hasn’t experienced a qualifying event or doesn’t have a sufficient amount of drift.

Daily Scan helps ensure that accounts can take advantage of tax-saving opportunities more proactively, without waiting for a standard rebalancing event. In turn, accounts using the TLH Daily Scan may rebalance more frequently.

The Altruist rebalancer utilizes the same holistic analysis each day, which is intended to apply balanced concern for tax efficiency and dispersion management. This approach helps ensure that pre-tax returns aren't negatively impacted as tax management is applied.

Benefits of more frequent harvesting

Studies, including one from Vanguard, show that more frequent portfolio rebalancing—such as daily tax-loss harvesting—can achieve greater average tax alpha compared to monthly, quarterly, or annual harvesting.

Source: Vanguard

The daily scan enhancement is optional and is accessible through the Tax Loss Harvesting toggle within TaxIQ. Tax Loss Harvesting is free on all fee-bearing marketplace models and only 10 bps per year for no-fee marketplace models and custom portfolios.

Client considerations for tax loss harvesting

It’s important to note that certain elements of tax management aren’t for everyone.

Here are a few considerations to keep in mind before implementing this strategy with your clients:

- Account availability: Altruist’s TaxIQ suite is only available for taxable accounts—tax-advantaged retirement accounts aren’t currently eligible.

- Your client’s current and future tax rate: By harvesting losses now, your client may be giving up harvesting opportunities in the future, which could lead to higher taxes if your client expects to be in a higher tax bracket.

- Risk factors: Enabling the daily tax loss harvesting scan may introduce risk factors, such as potential increased costs of replacement securities and potential increases in a portfolio’s tracking error.

(This is not an exhaustive list of considerations. Altruist does not provide tax advice and clients are encouraged to consult with a tax professional.)

Gain/Loss Summaries and Capital Gains Budgeting

In addition to our daily scan, our Tax Management capabilities include gain/loss summaries and capital gains budgeting, making it easier than ever for advisors to make smarter decisions for their clients.

The gain/loss summaries provide a clear view of realized and unrealized gains, streamlining the identification of TLH opportunities.

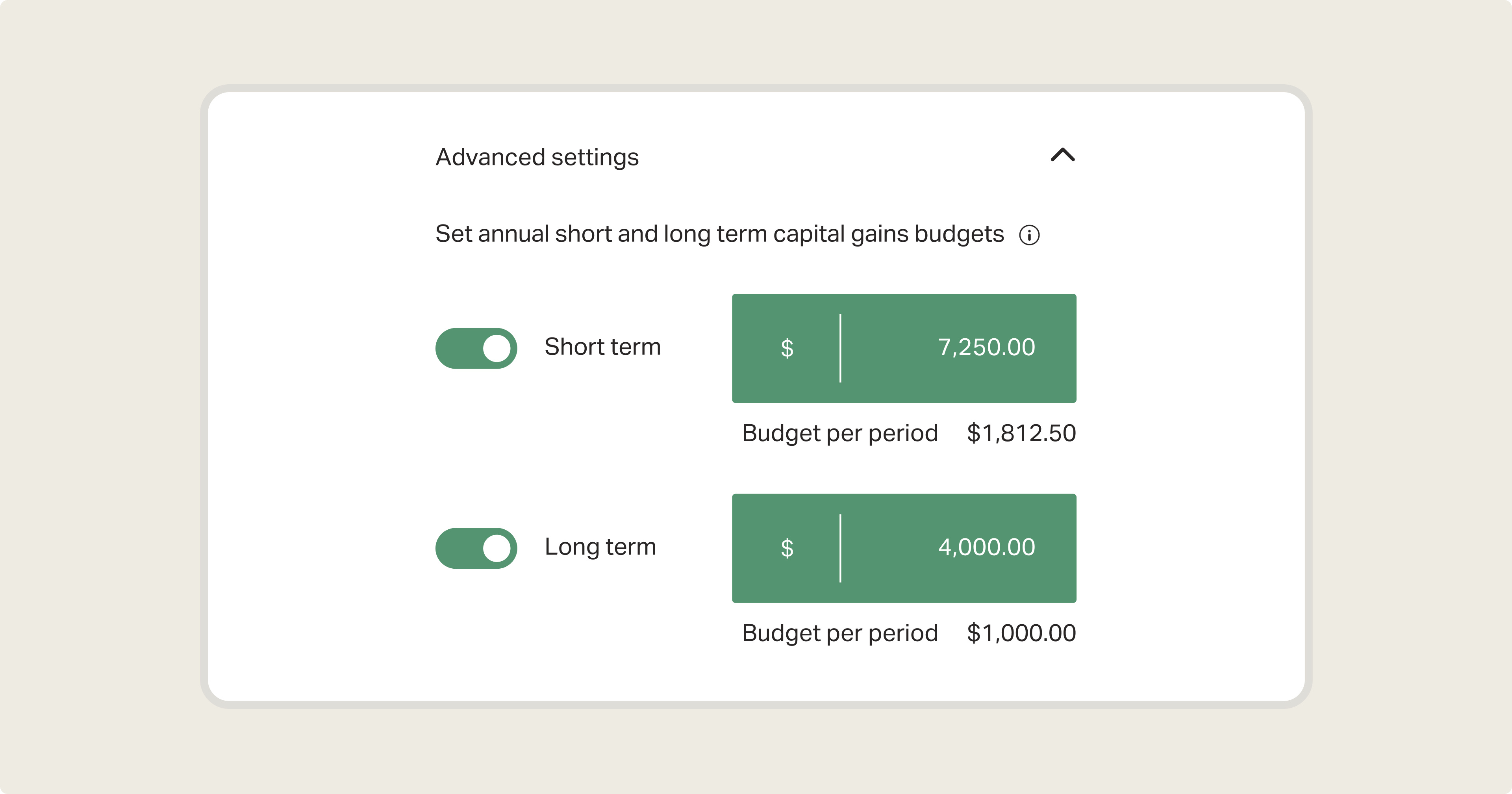

The new capital gains budget feature allows advisors to set a ceiling on net capital gains to be realized annually, ensuring a more strategic approach to portfolio management and tax planning. These enhancements empower advisors to deliver tax-smart, tailored outcomes for their clients. The capital gains budget can also be used to transition a taxable account from its current holdings to your desired portfolio in a tax-aware manner, spreading out the transition cost over time.

Want to learn more?

Want to learn more?

With the addition of daily scanning, capital gains budgeting, and gain/loss summaries, tax management at Altruist gives you even better tools to capitalize on ideal rebalancing opportunities and achieve greater tax alpha for your clients.

Reach out to Altruist today to learn more about our full suite of tax management solutions.