We're excited to announce that our latest integration with ACA’s Data and Analytics Solution, Ethos, is now live.

Ethos is a powerful offering from the ESG practice at ACA Group, the leading provider in governance, risk, and compliance solutions. It provides ratings and data that assists advisors to understand and design metrics programs according to client/investor preferences, tracks those metrics and report on progress over time, and advises staff on compliance around evolving ESG regulations.

This partnership reflects Altruist and ACA's shared vision of empowering financial planning with in-depth investment data and analytics, made accessible through modern, user-friendly technology paired with dynamic, customizable reporting.

"This partnership underscores our commitment to building a future where technology empowers advisors to create a positive impact through their work,” shared Luke Wilcox, Partner, Head of ESG Data and Analytics, at ACA Group. “Our Ethos technology offers transparent and actionable data to advisors, providing the insights they need to build impactful portfolios, while Altruist's intuitive platform makes it easy to integrate ESG analysis into their daily practice."

An integrated tech stack for advisors.

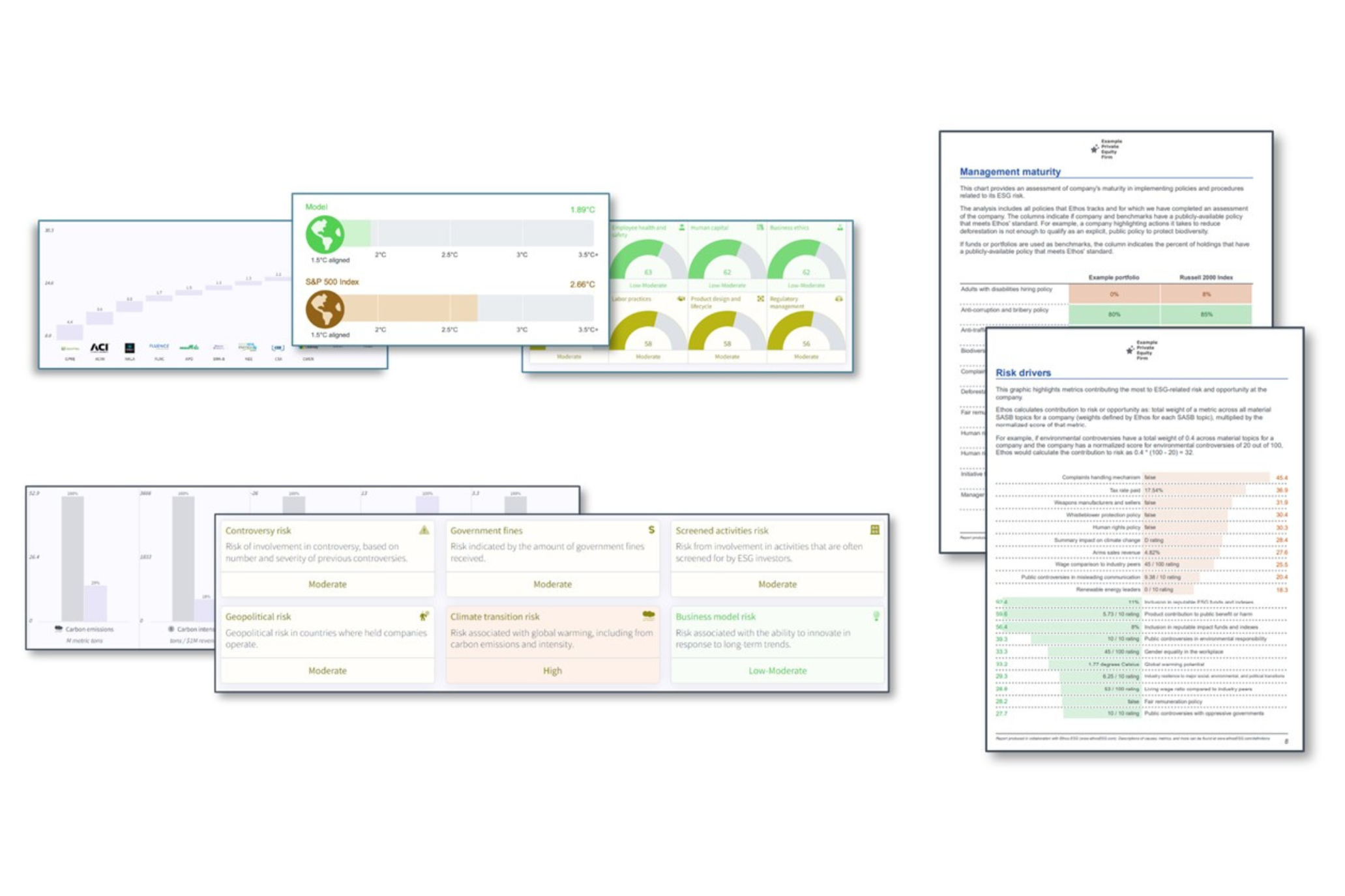

This integration offers financial advisors the ability to enhance transparency in ESG issues. By integrating Altruist households, accounts, and positions into Ethos, advisors gain access to over 800,000 impact and ESG risk ratings spanning companies and funds across 80 ESG topics, such as climate change and racial justice. Ethos' comprehensive database covers over 16,000 companies and funds, providing full transparency in impact and ESG risk score calculations and enabling portfolio uploads and model creation. This allows advisors to align investment decisions with both their firm's and their clients' ESG values and commitments.

Key benefits of the integration:

Ethos equips financial advisors with cutting-edge software and downloadable reporting to reach new clients, integrate impact data into their portfolio analysis, and deepen client relationships. By pairing the two platforms together, you can:

- Show impact on the causes your clients are passionate about with personalized client impact reporting.

- Analyze Altruist assets for ESG screens (such as fossil fuel or prison involvement) and much more. Advisors can then make adjustments in their custom models on Altruist accordingly.

- Establish an ESG framework with data collection and reporting for regulatory and other frameworks.

- Leverage visual analysis and storytelling that focuses on specific risk or impact issues.

Setting up the integration is simple:

- Log into Ethos and navigate to "Integrations" in "Firm settings".

- Client “Connect” under the Altruist integration box.

- Enter your Altruist username and password to link accounts.

- After being redirected back to Ethos, the data import from Altruist begins, taking approximately 5-20 minutes.

- Post-import, you can view Altruist households, accounts, and positions in Ethos under “Clients and Leads”.

- If you click into a Client, associated accounts from Altruist appear as Portfolios on Ethos.

Need help or have feedback?

For any queries or feedback regarding the integration, please contact the Altruist or Ethos success teams at support@altruist.com or success@ethosesg.com.