How modern advisors are balancing automation and the human touch.

- Advisors should consider using technology to automate rote tasks and to assist where human attention is required.

- What’s best performed by computers compared to advisors often depends on the practice and, in many cases, the specific client.

Computers can do a lot of things these days—win game shows, beat video games, even try to tell jokes. So how can they help us invest? As an integrated technology solution for RIAs, we ask ourselves this question every day at Altruist.

Accounting for an investor’s full financial picture and future plans is a complex endeavor, especially considering that plans change and the timing and priority of financial goals can be uncertain. Addressing the many factors required to create a comprehensive financial plan often takes a kind of intelligence only humans can offer. That said, many individual parts that make up an advisor’s practice can benefit substantially from technology.

Computers are better than humans… at certain things.

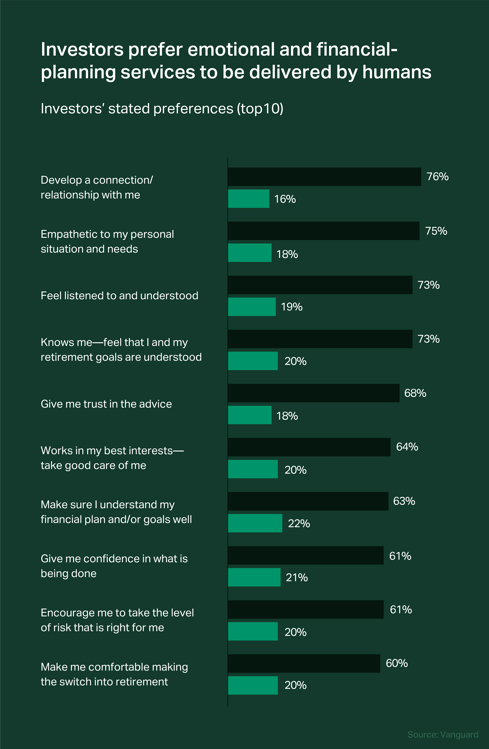

In general, humans are good at applying flexible thinking to solve complex problems. We can adapt when problems involve ambiguous goals and uncertain inputs. Furthermore, we have an incredible ability to connect with others to develop close, empathetic relationships and to deeply understand another’s circumstances. A recent Vanguard study showed that investors strongly prefer a person for financial planning and emotional topics.

Computers, on the other hand, tend to be better at doing lots of calculations fast and accurately, as well as performing rote tasks quickly and at scale. Monitoring, reading, and analyzing large amounts of data is a breeze for a machine that thinks in 1s and 0s. From the same Vanguard study, investors prefer and often expect automation for functional tasks.

Computers, on the other hand, tend to be better at doing lots of calculations fast and accurately, as well as performing rote tasks quickly and at scale. Monitoring, reading, and analyzing large amounts of data is a breeze for a machine that thinks in 1s and 0s. From the same Vanguard study, investors prefer and often expect automation for functional tasks.

An algorithm can optimize around known inputs for a well-defined outcome, but struggles when the inputs or the desired outcomes get fuzzy. Take saving for retirement as an example. A computer is much better suited for monitoring market fluctuations in IRA accounts and adjusting portfolios if they begin to stray from their mandate. Not only can the computer keep a watchful eye on the market, but it can also consider necessary adjustments across many accounts in parallel. The computer will have a harder time, however, helping a client navigate future tax rate uncertainty or prioritizing between competing goals.

Computers unlock tremendous power to organize and analyze data, and humans excel where computers stumble. Paired together, an advisor’s practice can benefit from increased efficiency and focus on helping deliver better client outcomes.

Scale to infinity

An advisor’s time is their scarcest resource, while a computer’s time is vanishingly cheap. For any task that does not require human judgment or a personal connection, an advisor should consider automating it. In doing so, they drive their time on it to zero and allow for an essentially infinite scale in that part of their business.

The average advisor spends less than 30% of their time meeting with clients, while operational tasks consume more than 40% of a typical advisor’s time in a week. What’s particularly notable is that the most successful advisors, measured by revenue, spend 50% more time with clients compared to less profitable practices (Kitces 2019, 2020).

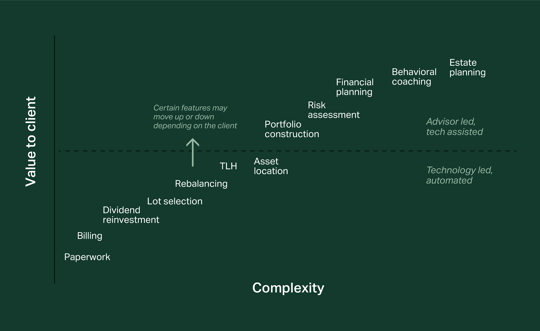

Below is a stylized chart that highlights the level of complexity and value to clients for many common advisor services. The less time an advisor can spend in the bottom left section (low value, low complexity), the more that advisor is able to use their time to generate meaningful value to their client.

Personalization matters—a lot

Personalization matters—a lot

Where automation works for one client, it may not work well for another. Ideally, the advisor has the flexibility to customize the experience and tailor the level of engagement to fit the client’s unique circumstances.

For example, a client with a more straightforward financial situation may be particularly well suited for automated tax loss harvesting. However, for a client with a more complex financial situation that includes external holdings and a more nuanced tax strategy, an advisor may want to identify, review, and propose a tax-harvesting transaction. In this case, technology can assist along the way, monitoring client positions, identifying harvesting opportunities, and alerting the advisor.

Clearly, there is no one-size-fits-all solution. The level of customization and advisor involvement may vary tremendously from advisor to advisor and from client to client.

Force multiplier

When decisions are best left to an advisor, technology can still be a powerful partner. In fact, technology may be at its most powerful when used alongside a skilled practitioner.

Consider risk assessment, for example. Computer-based tools can help an advisor tease out a client’s underlying risk preferences, and analysis of a portfolio's risk characteristics can help an advisor find the right fit for their client and facilitate a deeper conversion on the client’s concerns and goals.

Where human connection and intelligence is required, technology can enable an advisor to apply their specialized expertise quickly and to greater effect.

More time to focus on what matters

Technology frees advisors to focus their time on the highest-value activities for their clients. Low-complexity tasks can be automated away, and high-complexity, high-value activities can be enhanced by thoughtful tooling to supplement the advisor’s expertise. Our hope at Altruist is that we can empower advisors with the right technology so they can give great advice to more people.