Go deep with portfolio analysis with our new Kwanti integration

Go deep with portfolio analysis with our new Kwanti integration

Altruist advisors can now sync Altruist account positions, demographic data, and transactions in their Kwanti risk analysis software.

Kwanti combines powerful analytics and proposal generation to optimize the advisor’s time and resources. With Kwanti, you can go deeper into the analysis of investment risk and performance of investments custodied with Altruist beginning today.

To establish a connection between Kwanti and Altruist, log in first to Kwanti and follow these steps:

- Navigate to Import and select Altruist from the Data link column

- Select Activate this integration

- You’ll be redirected to log in to your Altruist account

- After the authentication, select Connect

- Again, you’ll be redirected back to Kwanti, and the integration will be established

Your Kwanti client analytics dashboards will be enriched with Altruist data within 1-2 business days. Kwanti will notify you by email as soon as your data is ready for analysis.

Kwanti marks our newest integration partner this quarter after launching integrations with Moneyguide and eMoney over the Summer.

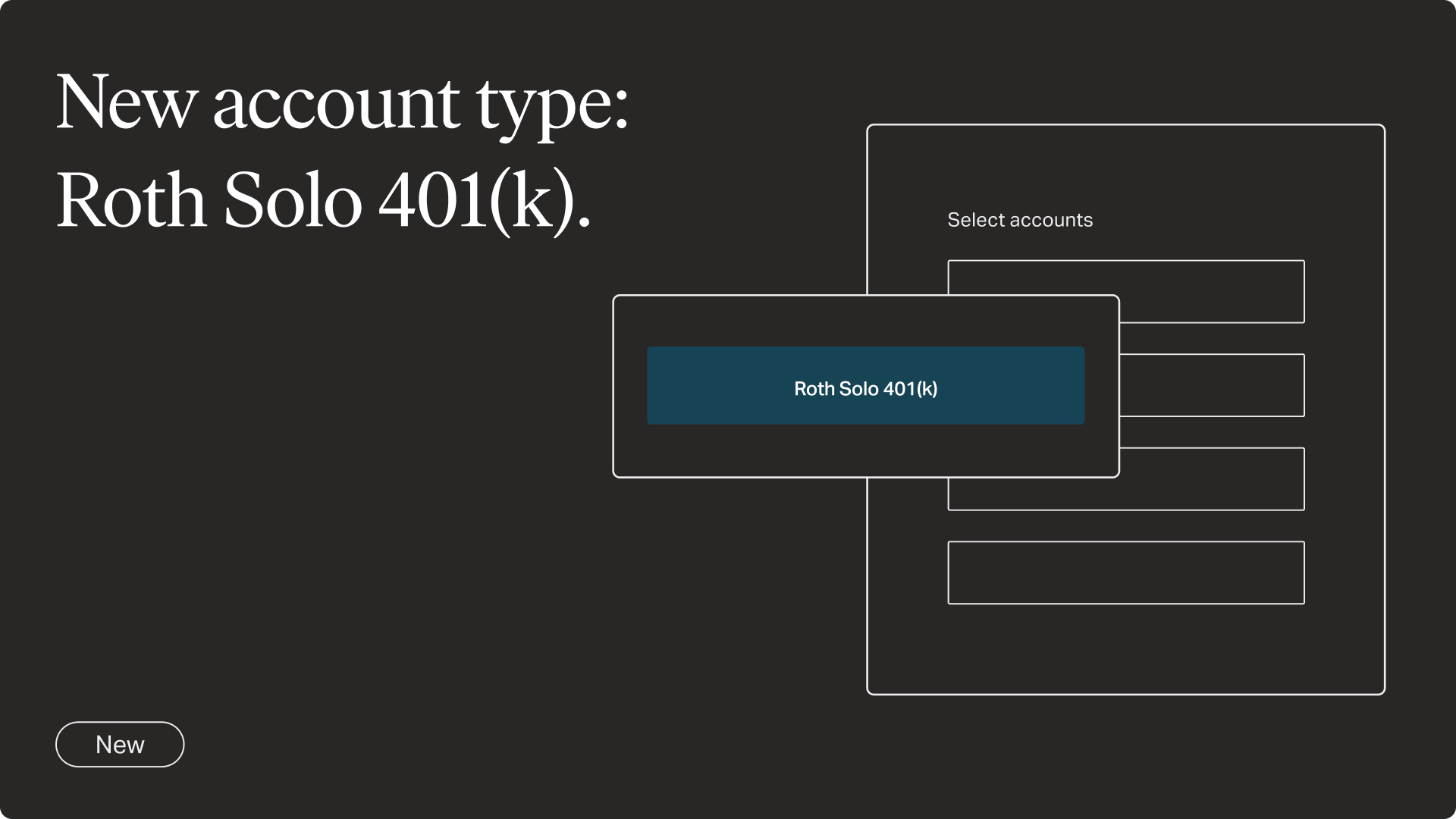

New account type added: Roth Solo 401(k)

New account type added: Roth Solo 401(k)

Advisors who manage business owner assets can offer their self-employed clients a 401(k) account option with Altruist and make after-tax contributions. A Roth Solo 401(k) offers the same contribution limits as a Roth 401(k) with a typical employer. Unlike a Roth IRA, the Roth Solo 401(k) has no income limitations that reduce or prohibit participants from contributing.

Roth Solo 401(k) adds to our ever-expanding lineup of account types, offering over 18 unique options to cater to your clients' diverse financial needs.

Eliminating PAS fees for Altruist brokerage accounts

Eliminating PAS fees for Altruist brokerage accounts

We shared this month that we're eliminating portfolio accounting software fees for Altruist brokerage accounts—a decision directly aligned with our mission to make independent financial advice better, more affordable, and accessible to everyone. Advisors who custody with Altruist now get built-in portfolio accounting, performance reporting, fee billing, portfolio rebalancing, and a modern client portal at no additional cost.

“Software and platform fees can become prohibitive to growth for large and fast-growing firms,” said Marc Greenberg, Chief Financial Officer at Altruist. “We are happy to offer a solution with scalable economics while simultaneously freeing up resources for more important things like client service, marketing, and operational efficiency.”

For advisors that work with other custodians, nothing is changing. They will continue to get their first 100 connected accounts for free and remain subject to a $1 per account per month fee thereafter.

To learn more about how this change will empower RIAs to drive better outcomes and help you run better businesses, read our CEO, Jason Wenk’s thoughts in his latest blog post.

* Keep in mind, other brokerage fees, Model Marketplace fees, and related expenses may apply on your client's assets. Please see the Altruist Financial LLC and Altruist LLC Fee Schedules and Subscription Pricing on our Legal page to learn more.

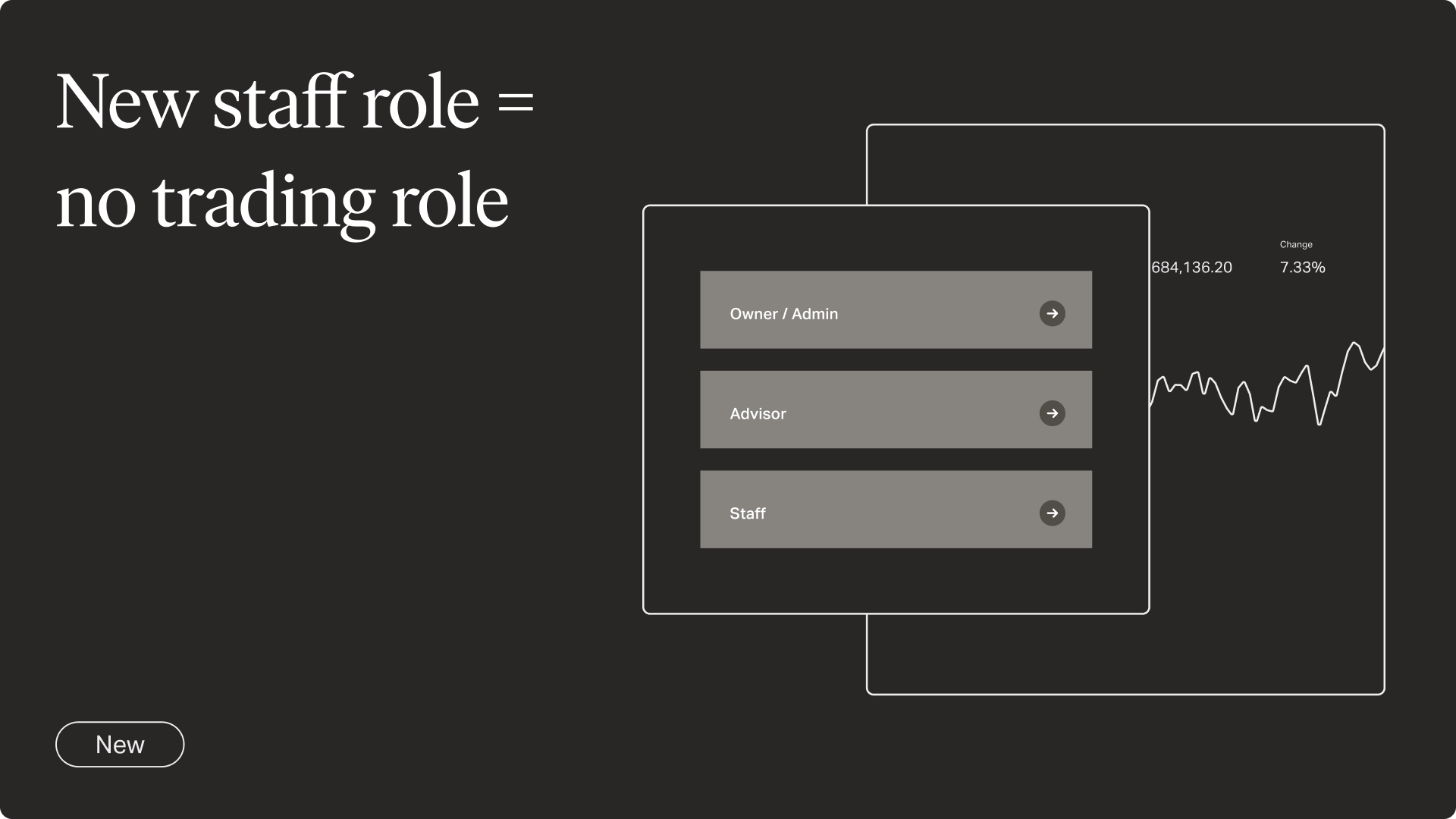

New staff role = no trading role

New staff role = no trading role

At Altruist, we understand the importance of fine-tuned control over your team's access and permissions. That's why we're introducing an enhanced Staff role type designed to cater to your operational-supporting team members who shouldn't have trading permissions.

We now offer three distinct role types you can assign in Settings:

- Owner/Admin Role: This role grants full authority, allowing team members to view and edit all aspects of Altruist.

- Advisor Role: Advisors enjoy access to specific households or account groups they're assigned to, complete with trading capabilities.

- Staff Role (new and modified): Our Staff role has been repurposed to provide access to assigned households or account groups while removing trading permissions. Staff members can't place trades, make model updates, or force a rebalance, ensuring airtight control over your operations.

We want to ensure a seamless transition for team members who were previously assigned the Staff role before this enhancement. With the new Staff role limitations in effect, they will experience restricted functionality immediately when this enhancement goes into effect on October 5th.

If you have team members in the Staff role who require trading access, we recommend reviewing their permissions and considering an upgrade to the Advisor role prior to October 5th, which you can do in Settings. This straightforward adjustment will grant them the necessary trading capabilities while maintaining the security and precision you need.

PMCO models have joined our Model Marketplace

Explore new strategies on the Altruist Model Marketplace from PIMCO, a definitive fixed-income investing leader.

These Models primarily draw on PIMCO's flagship funds as their core and core complement. They are supplemented by sector-specific strategies to seek broader diversification and the opportunity to source attractive yields across global bond markets.

The new PIMCO models can be accessed on the Altruist Model Marketplace at only 12 bps/year:

- PIMCO Tax Aware ETF Capital Preservation Model

- PIMCO Tax Aware ETF Enhanced Core Model

- PIMCO Tax Aware Mutual Fund Capital Preservation Model

- PIMCO Tax Aware Mutual Fund Enhanced Core Model

- PIMCO Tax Aware Mutual Fund Income Focus Model

- PIMCO Taxable ETF Capital Preservation Model

- PIMCO Taxable ETF Enhanced Core Model

- PIMCO Taxable Mutual Fund Capital Preservation Model

- PIMCO Taxable Mutual Fund Enhanced Core Model

- PIMCO Taxable Mutual Fund Income Focus Model

Both the allocation decisions across the funds and the underlying strategies leverage PIMCO's active investment process, combining their forward-looking economic views and rigorous credit research to help clients address their goals even in challenging environments.

Altruist’s Model Marketplace now offers over 350+ models across 19 fund providers. Learn more here.

Altruist LLC and its affiliates (together, “Altruist”) do not render investment advice to retail clients, rather Altruist makes available certain model portfolios for independent RIAs’ use in managing their retail investment clients’ assets. RIAs are responsible for suitability of all transactions in and decisions regarding client accounts, and must maintain discretion over client accounts which are subscribed to Model Marketplace model portfolios. For more information on Altruist’s Model Marketplace please see the Form ADV Part 2A, Model Marketplace Agreement and Altruist LLC Fee Schedule on altruist.com/legal.

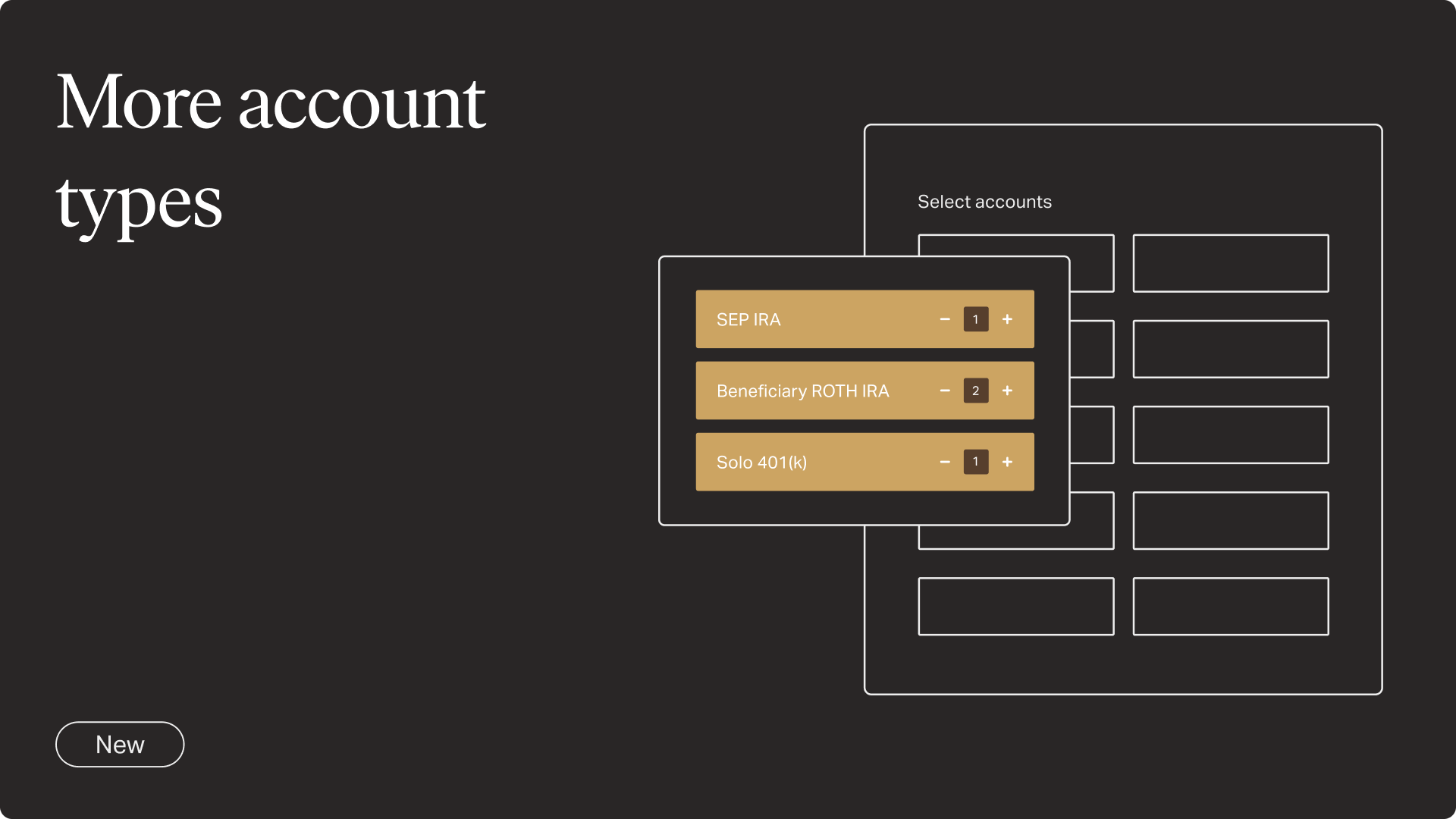

More account types added to multiple account bundling

Hot off of last month’s multiple account bundling announcement, we’ve already added additional account types to select from when opening accounts for your clients.

In addition to individual, joint, retirement, trust, and UGMA/UTMA accounts, you can now select SIMPLE IRA, SEP IRA, Beneficiary IRA, Beneficiary Roth IRA, and Solo 401(k) accounts–all in one streamlined experience.

Our enhanced account opening process modernizes digital onboarding, sparing you from repeatedly entering client details, eliminating tedious activity, and unlocking efficiency. And now, in one elegant email, you can prompt clients to open bundled accounts in significantly fewer steps. More to come soon as we build out this workflow further.

Other UX improvements you might have missed this month

Enhanced filtering on the Activity Page. We understand your work often involves tracking various transaction types for a holistic view of client account activity. Previously, our filtering options on our Activity page restricted you to one transaction type at a time or required manual data manipulation on your end. With this enhancement, you can select multiple transaction types simultaneously within the platform. And because we know that isolating activity data within specific timeframes is crucial, we've rolled out two essential filtering options for time periods:

- Year-to-Date (YTD): Easily access data that occurred during the current year without the need for manual exports. YTD analysis is a common practice in wealth management and is now at your fingertips.

- Custom Range: Tailor your analysis further by selecting a specific time period–ideal for addressing client inquiries and deepening your account analysis.

Extended inactivity timeout. We increased the inactivity timeout from 30 minutes to 60 minutes–offering you and your clients extended periods of inactivity without needing constant reauthentication. We're also actively exploring options for configurable timeout settings to tailor your experience to your preferences further.

Streamlined client mobile login: We've optimized the app to better retain trusted devices and user credentials, resulting in a dramatically smoother login process. Your clients will enjoy quicker access to their account and a more seamless mobile experience.

Intuitive client mobile logout: We've also revamped the logout flow to make it more intuitive and user-friendly, ensuring your clients have precise control over their session.