Manage bank linking in the Advisor Portal

Now, you can manage bank links directly in the Advisor Portal on behalf of clients during account opening. You can now also add or remove banks from clients' accounts from the household screen as shown below.

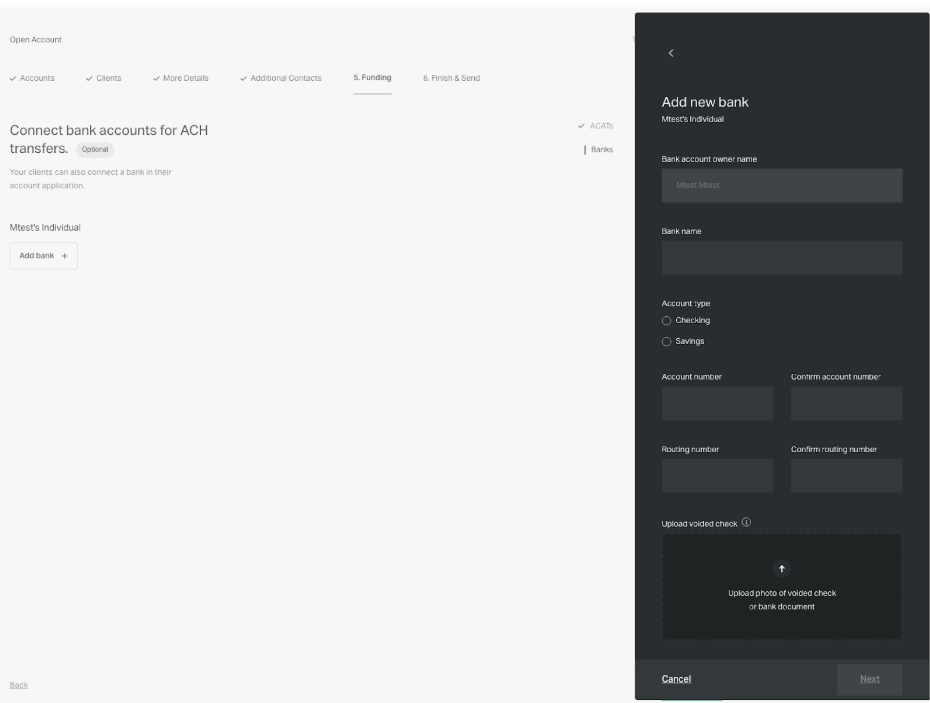

During the account opening process, on Step 5. Funding, you’ll now see a new Banks tab. Click on Add bank and a new drawer will pop up where you can fill in all of your client’s bank details on their behalf, as shown above.

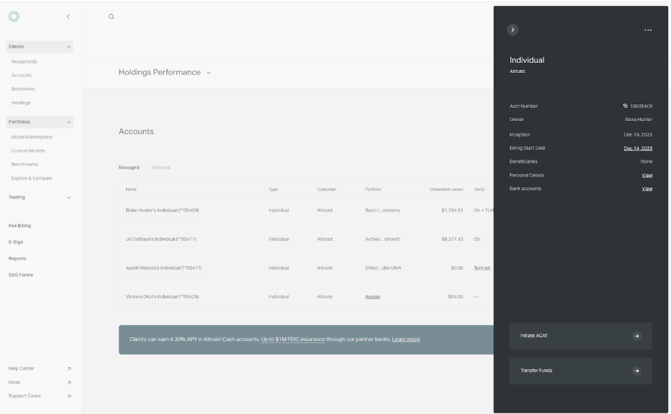

Alternatively, you can add or remove a bank after account opening too. Just locate the individual account in the Household page, and you’ll now see Bank accounts at the bottom of the pop-up drawer. Click View to add or remove linked banks to this account.

New upgrades to our TaxIQ Suite

We upgraded our TaxIQ suite with two brand new features:

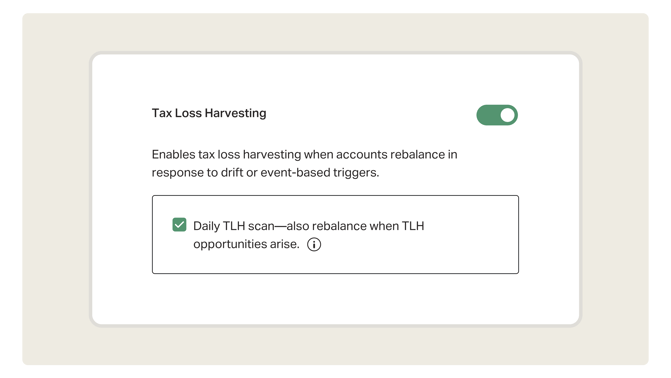

Our Tax Loss Harvesting (TLH) feature has now been upgraded with a Daily TLH Scan. The Daily TLH Scan helps capture tax-saving opportunities without waiting for a standard rebalancing event. With this new feature, eligible taxable accounts are scanned every day for potential losses to harvest (at least $100 or 1% of AUM). When sufficient losses are identified without incurring net gains, a rebalance will be automatically triggered.

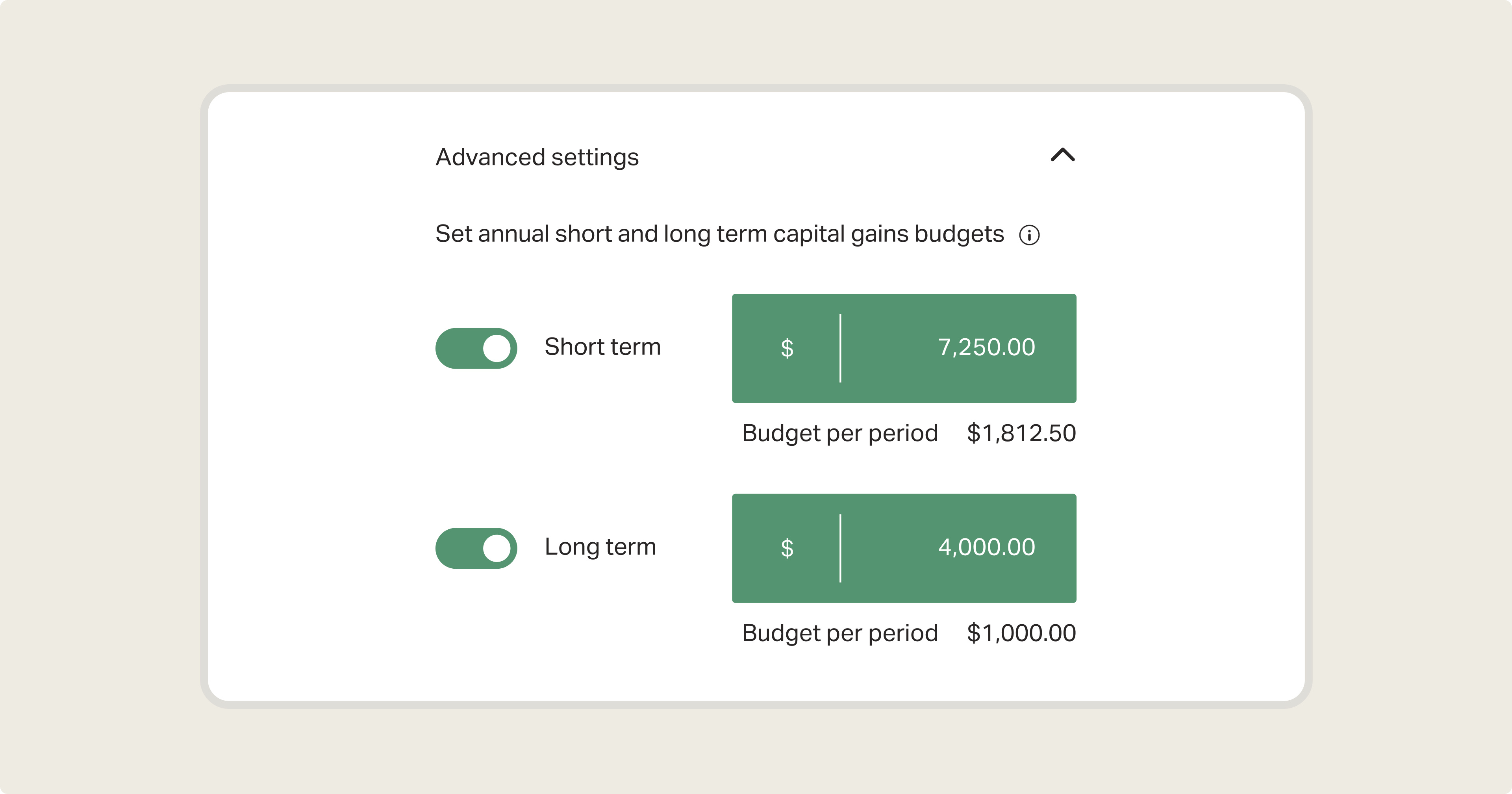

To give you greater control over portfolio management and tax planning, the new Capital Gains Budget feature allows you to set a ceiling on net capital gains, helping you manage taxable accounts with more precision. This can be particularly valuable for transitioning accounts from existing holdings to a target portfolio in a tax-efficient way, spreading the adjustments over time to help minimize tax impact.

The TLH Tool Fee remains 10 bps/year on Altruist, even with the Daily Scan and Capital Gains Budget features. Plus, the entire TaxIQ suite of tools is still free for fee-bearing Model Marketplace models and portfolios. Learn more about these new features here.

3 New Direct Index Models

We recently added 3 Direct Index models to the Model Marketplace, giving you more ways to customize strategies that best serve your clients while keeping costs low:

Altruist U.S. All-Cap Direct Index (share-based) - 15 bps/yr

This strategy seeks to track performance of the 3,000 largest U.S. equities, weighted by float-adjusted market capitalization.

Altruist U.S. Mid-Cap Direct Index (share-based) - 15 bps/yr

This strategy seeks to track the broad performance of U.S. mid-cap stocks. Specifically, the strategy seeks to track the 501-1,000 largest U.S. equities, weighted by float-adjusted market capitalization.

Altruist U.S. Small-Cap Direct Index (share-based) - 18 bps/yr

This strategy seeks to track the broad performance of U.S. small-cap stocks. Specifically, the strategy seeks to track the 1,001-3,000 largest U.S. equities, weighted by float-adjusted market capitalization.

Altruist’s Direct Index models also come with sophisticated tax management features, including automated tax-loss harvesting and customizable tax sensitivity settings, for free. Learn more about how Direct Indexing can get your clients more here.

Introducing the IRA Dashboard

We recently launched a new IRA Dashboard. This dashboard provides a firm and household level view of IRA contributions and distributions activity for a given tax year. Also, whenever a deposit or withdrawal is made, you can now see contributions and distributions for that account in the transfer drawer.

Never ask your clients for MMAs again

We implemented a faster MMA (Move Money Authorization) process, which provides clients a simpler way to opt-out and manage their MMA selections at the account level.

- No MMA requests needed: MMAs are now integrated directly into the Customer Agreement during client onboarding, eliminating the need for advisors to draft and request MMAs at the transfer level.

- A faster, simpler process: Once an account is open or a bank is linked, advisors have immediate authorization to initiate journals, ACH, and check distributions. There’s no need to wait for individual approvals on each account.

TaxIQ tax management tools (including, but not limited to tax loss harvesting) may lead to unfavorable tax impact depending on a number of factors including customer account holdings and asset location. TaxIQ Tools (including, but not limited to tax loss harvesting) may be impacted by a number of factors including a portfolio’s rebalancer and/or fund substitute settings. See the Altruist TaxIQ Tools and Rebalancer Disclosures document on altruist.com/legal for more information. Registered Investment Advisers (RIAs) are solely responsible for monitoring client accounts to ensure TaxIQ tools and settings are operating as intended. Neither Altruist nor its affiliates provide tax or legal advice or discretionary management of customer accounts. Customers are encouraged to consult their attorney, tax professional and/or investment advisor regarding their individual circumstance.

Altruist LLC and its affiliates (together, “Altruist”) and the Model Marketplace model providers do not render investment advice to retail clients, rather Altruist makes available certain model portfolios for independent RIAs’ use in managing their retail investment clients’ assets. RIAs are responsible for suitability of all transactions in and decisions regarding client accounts, and must maintain trading authority over client accounts which are subscribed to Model Marketplace model portfolios.

Certain instructions from model providers who are providing models to the Altruist Model Marketplace may not be executed based on system limitations, including securities that are not available to trade on the Altruist platform and rebalancing instructions that are not supported by the Rebalancer and trades that are below supported minimum trade sizes. Performance of individual accounts assigned to a model portfolio may deviate from the target model performance as a result of a number of factors, including Rebalancer settings, and timing and amount of cash flows and system limitations that impact execution of model provider instructions.