Introducing Altruist Cash with 5.10% APY

Introducing Altruist Cash with 5.10% APY

The Altruist Cash APY is 4.00% as of December 20, 2024. The 5.10% APY referenced in this article represents the historical rate as of the original publishing date.

Our own high-yield cash management account–one of the most highly requested features from advisors on our platform–is now live. Altruist Cash offers clients 5.10% APY on cash–11x the national average and comes with access to FDIC insurance through partner banks, up to $1 million for individual accounts and $2 million for joint accounts (Note: the referenced account type coverage limits are per person, not per account), and same day transfers between accounts. To ensure that these benefits are available to all types of clients, there are no minimum balance requirements as well as no setup or subscription fees.*

To learn more about Altruist Cash, you can read Jason’s blog post, visit our Altruist Cash web page, and sign up for the April 3 Office Hours where our team will chat live about it with you and your peers.

*Other fees may apply. See the Altruist Financial LLC Fee Schedule on altruist.com/legal to learn more.

Improved money movement with digital cash transfers

Improved money movement with digital cash transfers

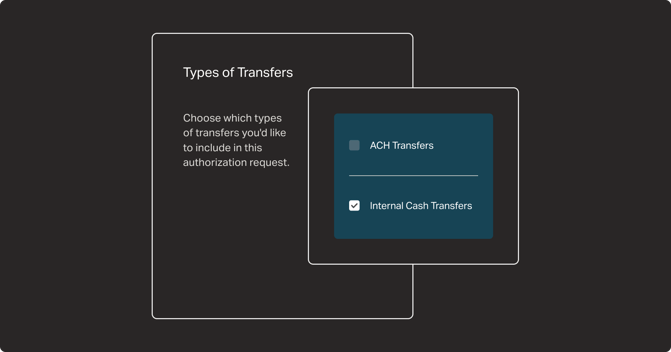

A long-awaited feature just arrived on Altruist: Digital cash journaling to support bi-directional internal cash transfers across accounts. This new functionality brings you a more efficient money movement, whether you're contributing to IRAs, handling RMDs, or simply moving funds between accounts. It introduces the flexibility to execute partial or full transfers and the convenience of scheduling these transfers on a weekly, bi-weekly, quarterly, or annual basis.

With the prerequisite of Move Money Authorizations (MMA) for both the sending and receiving accounts, advisors can now transfer funds between two eligible accounts. This process is initiated through your advisor portal by selecting a client account, choosing the transfer option, and then specifying the accounts for deposit or withdrawal. No more paper forms or individual client approvals for each transfer.

We understand the critical role that managing client cash plays in the services you provide. With the introduction of digital cash journaling, we're excited to release a more efficient process that advances how you manage client liquidity on Altruist, reinforcing our commitment to enhancing the tools and services independent advisors like you rely on.

We’re simplifying how you manage beneficiaries

We’re simplifying how you manage beneficiaries

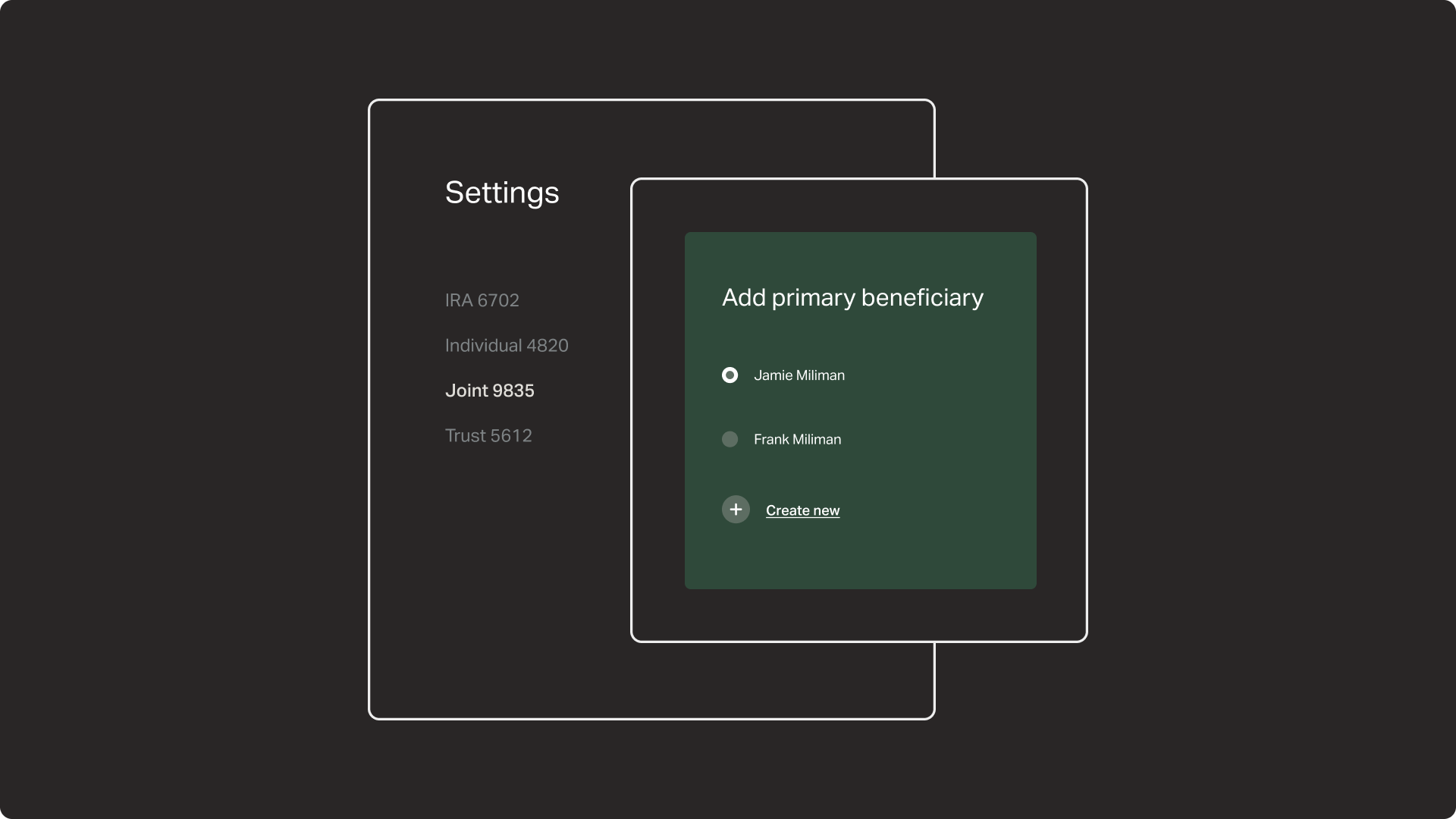

We're excited to share significant enhancements to our beneficiary management system, a critical aspect of account opening and maintenance. Recognizing the limitations of our previous system, such as the inability to reuse or easily update existing beneficiaries, we've implemented comprehensive improvements made possible by our transition to Altruist Clearing last year.

Now you can easily view and apply existing beneficiaries toward new accounts in your Advisor Portal. This update facilitates the reuse of beneficiaries for both new account openings and existing accounts. Additionally, edits to beneficiaries can now be universally applied to all associated accounts or targeted to specific ones.

Your clients also get the added convenience of updating their beneficiaries post account opening through their Client Portal without forms.

We've also increased the character limit for name fields, improving data entry accuracy and user experience. Beneficiaries added via forms are now visible in both the Advisor and Client Portals, enhancing transparency and control over account management.

New Accounts Report to help with your compliance needs

New Accounts Report to help with your compliance needs

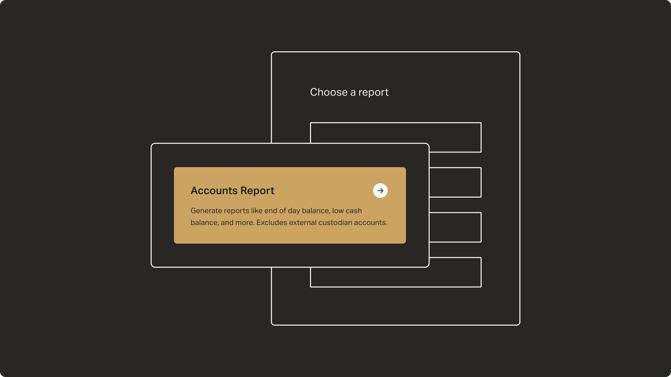

Altruist is grounded in the principle that your data belongs to you. In our latest stride toward transparency and accessibility, we introduce the Accounts Report—a tool designed to streamline your reporting process for regulatory compliance and internal team requirements. This feature allows you to tailor the presentation of your account information on Altruist, enabling the customization of data views by time period, data points, and their display order. Effortlessly adjust the layout through a simple drag-and-drop interface to organize columns as needed.

By default, reports capture data as of the current date. However, the flexibility to retrospectively generate reports for specific periods, such as year-end, is also provided. The report includes critical data points such as account balance, cash balance, account opening date, account owner's name, account name, account number, client address, birthdate, and more, ensuring comprehensive account management. You can also export all data into a CSV.

Simply click on your avatar at the top right corner of the Altruist platform and select "Reports" from the dropdown menu to check out the new Accounts Report. Coming soon, we’ll be adding more data points to make this report even more comprehensive.

Introducing the Altruist + Smartria integration for trade monitoring

Introducing the Altruist + Smartria integration for trade monitoring

Smartria streamlines your compliance operations with flexible, automated workflows, risk alerts and transparent reporting.

Compliance technology is essential for RIAs to devise and implement detailed policies and procedures, supervisory systems, and ethical codes aimed at preventing violations of securities laws.

This collaboration marks Altruist's initial venture into integrating with a specialized compliance management software. It enables seamless data transfer to Smartria, facilitating the monitoring of trade activities.

To initiate this integration, contact Smartria's customer service by emailing hello@smart-ria.com or calling 833-497-6278. After activation, log into Smartria, navigate to Settings > Integrations, and connect to Altruist (you can find us under Custodian Data). Smartria will then regularly update data from Altruist to ensure continuous monitoring.

Easier and more welcoming mobile signup for your clients

Easier and more welcoming mobile signup for your clients

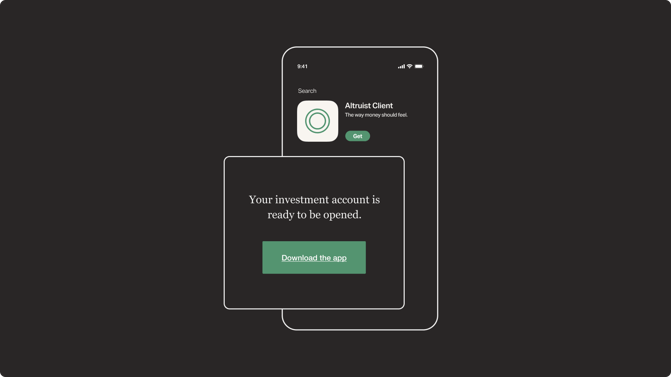

Understanding the critical role first impressions play in your advisory relationships, we’ve taken your feedback to heart and transformed our client signup process. Recognizing the previous steps were a bit clunky at times, we're excited to unveil a redesigned, more intuitive experience for your clients joining Altruist via mobile.

Now, when clients are invited to the Altruist Client Portal, they bypass the web browser altogether. Instead, they're prompted to download the Altruist Client mobile app directly, where they can complete the signup process in just a few clicks in the palm of their hand. This includes creating their login credentials, setting up two-factor authentication, and immediately reviewing and accepting your account opening invitation.

Moreover, if you've personalized your Altruist settings with your firm's logo, co-branding will be reflected throughout the entire signup process, offering a cohesive and professional appearance from the start as they make their introduction to Altruist.

Clients who are already using the Altruist mobile app will benefit from an even more streamlined process. New account invitations will include a deep link, guiding them directly within the app to accept and proceed, enhancing the workflow and saving time.

For clients who prefer or need to use a desktop, the traditional browser-based signup remains an accessible option.

Get ready for T+1

We are reaching an important milestone in our industry's evolution–the transition from a T+2 to a T+1 settlement cycle. This change will commence on May 28, 2024, impacting the settlement period for most U.S. and Canadian securities traded on U.S. exchanges. Specifically, trades executed on or after this date will settle the next business day.

This modification signifies a significant step towards enhancing the efficiency and reducing the risk within our trading environment.

Please note, this transition requires no action on your part or that of your clients. As an industry-wide adjustment, the T+1 settlement cycle will automatically apply to all eligible trades executed from May 28, 2024, onwards.

Other UX improvements you might have missed this month…

Accessibility improvements. Advisors have shared feedback that the checkboxes at the end of our digital account opening application for clients to mark were in such a light color that clients sometimes missed them completely. We just rolled out UX design enhancements that improve the visibility of forms at this step to make them can't-miss.

APY is variable and can change. FDIC insurance is limited to $250,000 per depositor, per FDIC-insured bank, per ownership category and is subject to conditions. Neither Altruist Financial LLC nor any of its affiliates are banks.

Cash must be deposited with Partner Banks to become eligible for FDIC insurance up to $1 million for individual accounts / up to $2 million for joint accounts. If cash is held at Partner Banks outside of the Altruist Cash program, it can impact the total FDIC coverage amounts.