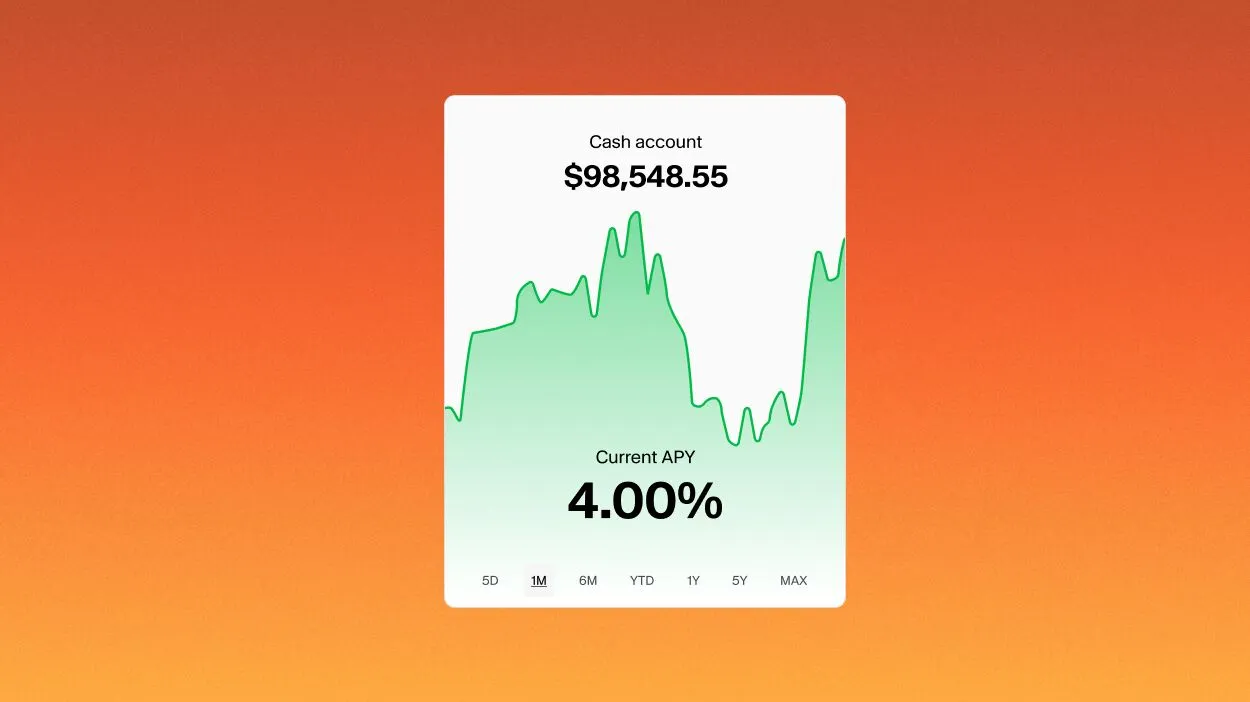

The Altruist Cash APY is 4.00% as of December 20, 2024. The 5.10% APY referenced in this article represents the historical rate as of the original publishing date.

When it comes to clients’ cash balances, advisors have had been forced to make a conscious trade-off. Reduce visibility into their clients financial picture by pushing them to third party solutions for attractive yield–an administrative headache for the client… or maintain oversight of client cash in a custodian held sweep account with meager yield.

You shouldn’t have to choose.

Altruist Cash represents our commitment to meeting the needs of advisors and their clients with industry-leading 5.10% APY on cash balances—11 times the national average* and significantly higher than Schwab, Fidelity, and Pershing. The new product is available to clients of any RIA, regardless of their current custodian.

Altruist Cash was inspired by feedback from nearly 100 advisors.

The feedback was shared directly with our product teams through the Advisor Idea Portal. Some comments that stood out were:

“My clients hate that they have separate log-ins and would love to have everything in one place.”

“This would be so huge and avoid the hassle of having another login at Betterment or Max or Flourish.”

“It would be great not to have to send clients to third-party apps like […] and have it all done in one place”

Altruist Cash gives clients attractive yield without having to manage another login.

For Advisors, it means more holistic coverage of their clients’ financial picture right within Altruist. Additional key features of Altruist Cash include:

- FDIC insurance up to $1 million for individual accounts and $2 million for joint accounts, through our extensive partner bank network. (Note: the referenced account type coverage limits are per person, not per account).

- Immediate access to funds, providing clients with the flexibility of same day liquidity.

- Inclusive access with no minimum balance requirements.

- Advisors can journal/transfer cash to and from Altruist Cash directly to their clients’ Altruist investment accounts.

Altruist Cash is a notable addition to a broader array of tools designed to help advisors drive greater impact and better client outcomes. That includes fractional share trading, fully paid securities lending, and an upcoming suite of automated tax savings tools.

For more information about Altruist Cash

I encourage you to visit altruist.com/cash where you can register for our 4/3 Office Hours. I’ll be doing a detailed exploration of the product on that call.

For the folks who prefer podcasts, you can also learn more by listening to our latest episode of The Advisor Journey where Dasarte Yarnway and I break down the cash management dilemma (and how Altruist Cash solves it) in detail. Listen here.

*The national average interest rate for savings accounts as posted on FDIC.gov, as of January 21, 2025.

The Annual Percentage Yield (“APY”) for the Altruist Cash accounts (“Altruist Cash”) is variable and may change at any time. The amount of interest you will receive on your deposits will vary based on a number of factors. Accrued interest is paid on the last business day of the month directly into the Altruist Cash account. View our disclosures to learn more.

Altruist Cash is offered through a separate account at Altruist Financial LLC (“Altruist Financial”) that is opened solely for participation in Altruist Cash. Neither Altruist Financial nor any of its affiliates are banks. Altruist Financial deposits cash in the Altruist Cash account with one or more banks (“Program Banks” see the Altruist Financial LLC Participating Bank List) that accept and maintain such deposits. Through Altruist Cash, clients’ cash is deposited into Program Banks where the cash earns a variable interest rate and is eligible for FDIC insurance. Cash is not eligible for FDIC insurance until the cash is deposited at the Program Banks. Cash in the Altruist Cash account that is awaiting to be deposited in, and cash in transit to or from, Program Banks, may not be eligible for coverage under SIPC. SIPC coverage does not apply to cash deposited with Program Banks. FDIC insurance is limited to $250,000 per depositor, per FDIC-insured bank, per ownership category and is subject to conditions. More information can be found in the Altruist Cash Disclosure Statement and the Altruist Financial LLC Participating Bank List, both available on altruist.com/legal. FDIC coverage can be impacted by several things, including but not limited to deposit capacity at a Program Bank and/or if a client holds cash at a Program Bank, including through this or additional sweep programs. Clients are responsible for monitoring their total assets at each of the Program Banks, whether through Altruist Financial accounts or accounts with other financial intermediaries, to determine the extent of available FDIC insurance coverage in accordance with FDIC rules. For more information on FDIC insurance coverage, please visit FDIC.gov.

Deposits to Altruist Cash will be deposited with Program Banks on the following business day. Cash deposited via ACH or Check may take three (3) or more business days for the funds to become available for deposit. Customers can initiate withdrawals at any time from the Altruist Cash account. View our disclosures to learn more.

Clients should carefully review the information provided on altruist.com/legal to determine whether Altruist Cash is an appropriate product for their specific financial needs. Retail clients must work with a Registered Investment Advisor to open an Altruist Cash account. Securities trading is not possible in the Altruist Cash account.

Altruist Corp (“Altruist”) offers technology and tools designed to help financial advisors achieve better outcomes. Advisory and certain other services are provided by Altruist LLC, an SEC-registered investment adviser, and brokerage related products and services are provided by Altruist Financial LLC, a member of FINRA/SIPC. Commission-free trading means $0 commission trades placed in brokerage accounts via web or mobile devices. Other fees may still apply. Please see the Altruist Financial LLC Fee Schedule on altruist.com/legal to learn more.