In our recent webcast on de-mystifying crypto for RIAs and your clients, we discussed the state of crypto investing with Michael Sonnenshein, CEO of Grayscale Investments, the largest digital asset manager, and Jackson Wood, a financial advisor who’s been involved in crypto investing since 2012.

By and large, cryptocurrencies have matured as an asset class and are seeing larger participation from a broader segment of investors. This means financial advisors should understand when an allocation makes sense for a client and how it might fit in their portfolio. Below, I’ve boiled down the key takeaways from the conversation and themes we explored:

Crypto has matured

By almost every metric—market value, number of transactions, active wallets—cryptocurrencies have grown at a phenomenal pace. The asset class is also showing signs of maturation. Crypto is no longer dominated by one coin. While still the largest, Bitcoin is no longer the only game in town and now represents about 40% of the crypto market. Other protocols, like Ethereum and Solana, are seeing meaningful adoption.

Bitcoin share of total cryptocurrency market (Source: Statista)

Additionally, correlations to other risky assets have increased over time. While correlations are still relatively low, the fact that Bitcoin is trading more similarly to other established assets suggests a new level of maturity. If the maturation of the asset class continues, we may also start to see volatility decrease in the future.

Additionally, correlations to other risky assets have increased over time. While correlations are still relatively low, the fact that Bitcoin is trading more similarly to other established assets suggests a new level of maturity. If the maturation of the asset class continues, we may also start to see volatility decrease in the future.

But, we’re still in the early innings

While the space has certainly matured, crypto investing is still very much in the early days. Given the pace of growth, it’s easy to feel like the ship has already sailed. To put it into perspective, most asset classes have been around for decades if not centuries. Bitcoin is a little over 10 years old. Much of the important innovation is likely in front of us, not behind.

As an emerging asset class, crypto still faces very real structural questions. For example, how will regulation impact the development of the market? And will crypto protocols achieve mass adoption or remain niche? Early signs are positive: The SEC appears to want to work with crypto assets, not regulate them out of existence, and we have seen more institutional investors bolster protocol adoption. But these risks are always evolving.

When to include crypto in client strategies

Price volatility and underlying structural risks put crypto in the speculative asset category. Investors should be able to stomach steep declines and the possibility of permanent capital loss. There's no one-size-fits-all approach to allocating crypto. Understanding the risk tolerance and capacity of the client will help determine if an allocation to crypto makes sense. As the asset class continues to mature and if its volatility declines, the use cases will likely increase.

For those who wish to include crypto, the asset class presents some interesting properties, including low correlation to traditional assets and the potential for a high rate of return. If it makes sense for their clients, advisors may consider crypto’s weight in the global market portfolio—1-2%—as a neutral starting point and scale positions up or down from there.

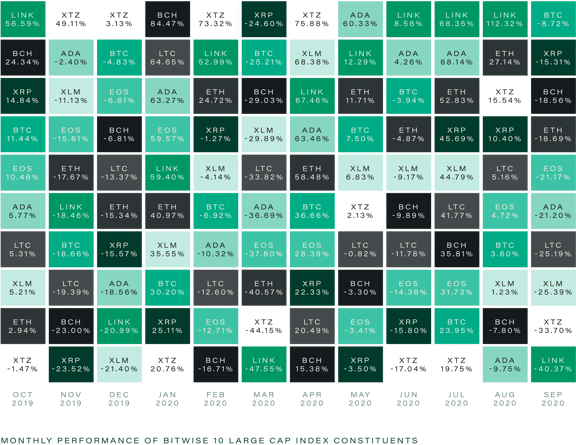

The panelists agreed that diversification is particularly important, especially as the space evolves. The dominant protocols today could be eclipsed by newer initiatives down the road, and knowing which specific assets will perform well is difficult to predict. Similar to the famous “quilt chart” for traditional asset returns, an unpredictable pattern emerges when looking at crypto assets. Check out this chart of the Monthly Performance of Bitwise 10 Large Cap Index constituents (source: CFA Institute):

How to include crypto

How to include crypto

Today, advisors have more ways than ever to access crypto assets, each with their own benefits and tradeoffs. Crypto futures ETFs allow for exposure in the familiar ETF format. Experts will be watching to see how futures ETFs manage rolling their positions into next months’ contracts as their holdings reach expiration, which has been a source of performance slippage for some futures funds. It’s also important to remember that crypto futures are taxed as futures while cryptocurrencies themselves are taxed as property.

Crypto trusts hold underlying crypto assets directly and trade in the secondary OTC market. While these trusts hold actual crypto assets, their shares on the open market can trade at a premium or discount to the value of their underlying holdings. Buying the crypto assets directly avoids additional financial instruments, but the custody and trading infrastructure to make these products broadly available to advisors is still developing.

The crypto space is nothing if not exciting and developing quickly. The growth potential, volatility, and possible transformational change within the industry have captured the interest of many. More than 10 years since Bitcoin was created, crypto assets have matured and the investor base has broadened. However, the asset class is still emerging and carries the structural risks and volatility of a developing sector with it. Allocations to crypto will greatly depend on individual client investment profiles and risk preferences.

Stay in touch

Thinking about cryptocurrency exposure for your clients or have any suggestions for topics you’d like us to cover? Let us know at webinars@altruist.com.

Investing in Exchange-Traded Funds (ETFs) involves risks, including loss of part or all of the principal amount invested. Shares may be worth more or less than their original cost when redeemed. There can be no assurance any fund will meet its objectives. Crypto-linked ETFs do not invest in or hold the referenced crypto directly, they offer exposure to crypto futures which are speculative (generally for shorter-term trading), highly volatile, and may underperform the “spot” price of the referenced cryptocurrency. An investment in the fund may not be suitable for all investors.

ETFs are sold by prospectus, which includes risks, fees and expenses, fund objectives and other important information. Visit https://www.proshares.com/our-etfs/strategic/bito (BITO), https://valkyrie-funds.com/btf/ (BTF), https://www.vaneck.com/library/page_lit.aspx?id=399 (XBTF) and https://www.spdrgoldshares.com/usa/ (GLD) to obtain a copy of the prospectus, which should be reviewed carefully before deciding to invest or sending any money.

Please note: certain funds referenced in linked article content are not currently available for US investment.

Securities that trade “Over the Counter” (OTC) offering crypto exposure are speculative and involve significant risks including but not limited to increased volatility, limited liquidity and increased expenses. Investments in these securities do not represent direct ownership of the referenced cryptocurrencies, and may significantly underperform the referenced cryptocurrencies. Investments in such products may not be suitable for all investors.

This material is intended for information purposes only and should not be considered a recommendation to buy or sell any investment. Certain statements are forward-looking in nature, there can be no guarantee that the events described will come to pass.