Advisors, we are thrilled to share that the Altruist + Income Lab integration is now live.

Retirement income planning and management is paramount to a holistic offering from advisors today but requires a proactive approach. Both firms believe it’s a critical component of financial wellness and best achieved when combining modern, user-friendly technology with comprehensive financial insights.

“At Income Lab, we are committed to providing advisors with a first-class experience on our platform”, said CEO and Co-Founder, Johnny Poulsen. “We are excited to integrate with Altruist and align with their mission to make financial advice better, more affordable, and accessible to everyone. The integration improves the user experience and helps advisors gain efficiencies - saving them time and more importantly helping them create better retirement plans for the clients they serve.”

An integrated tech stack for advisors

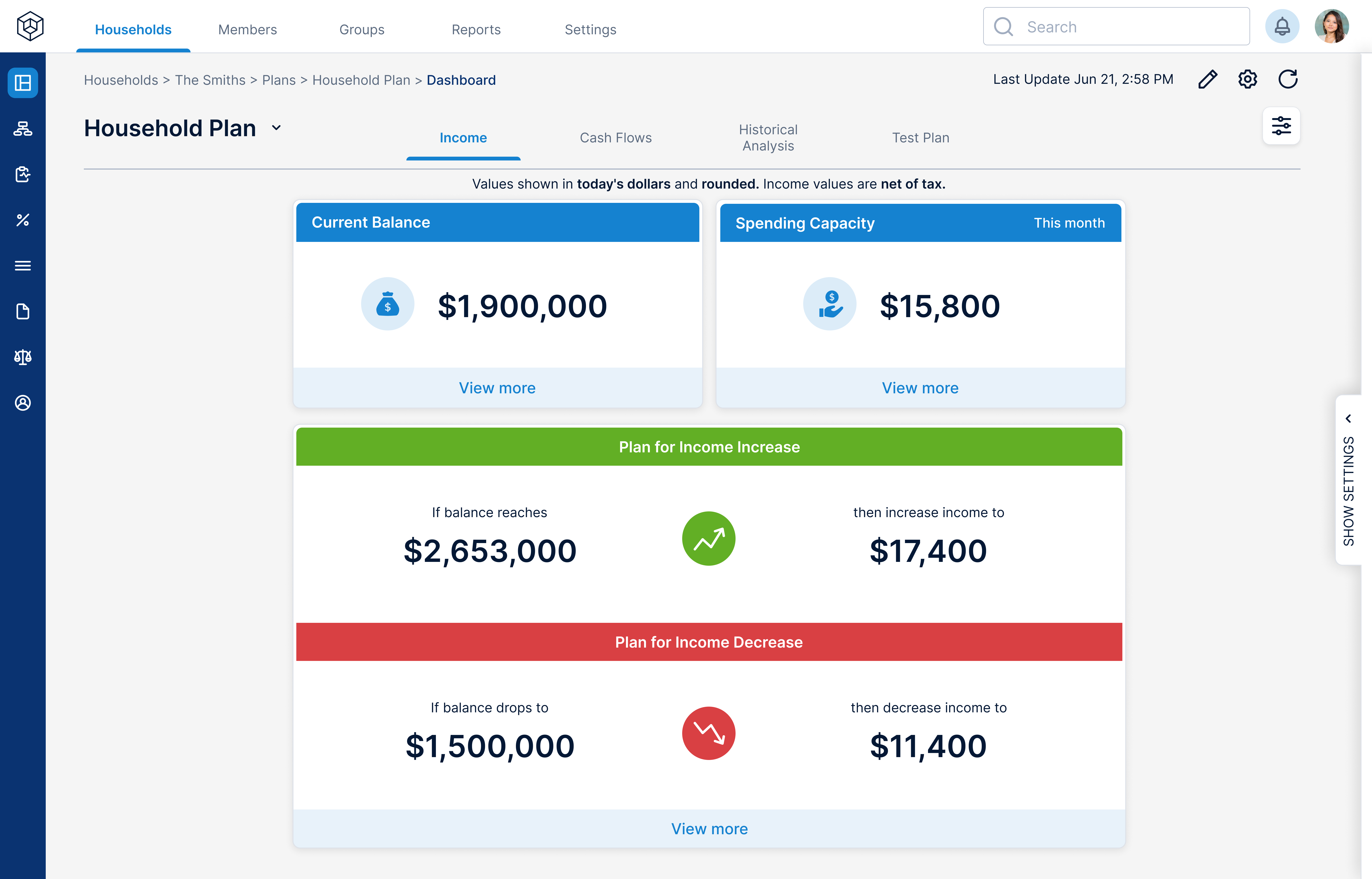

The integration enables advisors to streamline retirement income planning by importing Altruist households, accounts, and data into Income Lab. It facilitates automatic updates of client account balances, ensuring advisors have the most current data for effective planning. With the capability to create and manage retirement income plans incorporating data from Altruist custodial accounts, advisors are better equipped to offer holistic financial advice.

Key benefits of the integration

Key benefits of the integration

Income Lab provides financial advisors with cutting-edge software for ongoing retirement income management and client engagement. Advisors use Income Lab to give clients targeted, customized advice about how much they can spend, when and how to adjust spending for evolving economic and market conditions, and how to optimize distribution plans for tax efficiency.

- Automated account balance updates from Altruist within Income Lab for real-time portfolio data.

- Inclusion of investment account information in Income Lab’s Life Hub for a complete financial overview on one page.

- Simplified creation of tax-efficient distribution plans, including easy execution of Roth conversions.

Altruist Founder and CEO Jason Wenk emphasizes the significance of this integration: “Clients often prioritize achieving a secure and comfortable retirement. We are thrilled about our new integration with Income Lab, empowering advisors to turn their clients into confident investors and retirees. This integration aims to help advisors reduce financial stress and anxiety for their clients with big-picture context.”

Setting up the integration is simple

- Log into Income Lab and navigate to "Integrations" under "Settings".

- Click "Add Integration" and select Altruist.

- Enter your Altruist username and password to link accounts.

- Once redirected back to Income Lab, Altruist will be listed as active.

- On your dashboard, select a household and edit the Income Plan.

- Under "Assets," click "Add Linked Accounts" and choose Altruist as the source.

- Select and save the desired accounts to link.

Further resources and upcoming events

For detailed instructions, including videos and screenshots, visit the Altruist - How to Integrate guide in the Income Lab Help Center.

Also stay tuned for a live webinar in January featuring Altruist and Income Lab, where we’ll delve deeper into how this integration benefits clients and enhances advisor capabilities. Invitations will be sent after the New Year.