Live phone support has arrived

Live phone support has arrived

We’ve been quietly piloting live phone support in beta since the start of the year, complementing our robust live chat and email services. We are excited to announce that our upgraded phone support team is now ready to take your call. This enhanced service model underscores our unwavering commitment to providing unparalleled support and operational services, meticulously crafted for RIAs and their unique practices.

Comprehensive support for independent advisors

When you choose Altruist, you gain access to a team of operational and client service professionals dedicated solely to independent advisors. Our full support network now includes:

- Upgraded live phone support: Personalized attention with calls answered within 30 seconds on average.

- Live online chat: Offering industry-leading response times, typically within 30-45 seconds.

- Email Support: For detailed inquiries and follow-ups.

- Help Center: An up-to-date digital knowledge base for quick, self-service solutions.

Personalized and empowered service

Our support representatives are empowered to own your challenge from start to finish, ensuring issues are resolved efficiently and effectively. We guarantee that your cases won't be closed until you are 100% satisfied, delivering the human touch that goes beyond artificial intelligence or chatbots.

Setting a new standard in support

At Altruist, we've designed our support exclusively for RIAs, ensuring you receive the attention and expertise you deserve to help you thrive.

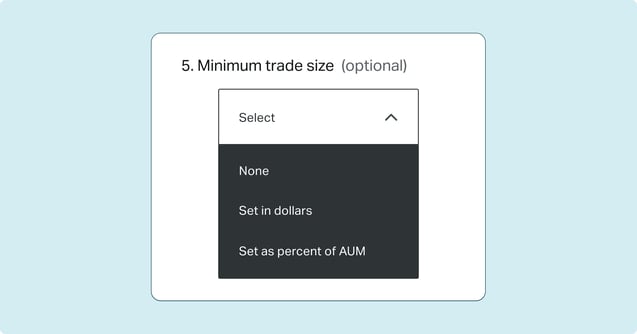

Set a minimum trade size for portfolio rebalancing

In our continued effort to enhance your portfolio rebalancing experience, we're excited to introduce a new optional feature for setting minimum trade sizes (MTS). This addition allows you to define trade sizes as either a percentage of AUM or a fixed dollar amount, giving you increased control and flexibility, and can be particularly useful for limiting tiny or de minimis trades, where the rebalancer seeks to trim positions back to target weight.

To aid you in choosing an optimal value, we've incorporated in-app guidance which will customize based on setting your MTS in dollars or as a percent of AUM. It takes into consideration other portfolio settings like your drift tolerance and smallest allocation in the portfolio. Greater detail on this can be found in our MTS Help Center Article.

Once you establish your minimum trade sizes, they will be visible on the Portfolio Review screen. Additionally, they'll be displayed as a new column on the Portfolio List page, within the Portfolio Drawer, and in the Rebalancing Drawer, which you can access through Event-based or Drift-based links from an account's Holdings page

Specify a drift tolerance for event-based rebalancing

Specify a drift tolerance for event-based rebalancing

In yet another enhancement to portfolio rebalancing, we introduced new settings for event-based rebalancing. Now you can specify drift tolerance levels. This new setting does not initiate a rebalance, but rather gives you greater control over how close a security or model must be to its target weight post-rebalance. The inclusion of drift tolerance is particularly beneficial as it provides clarity on rebalancing triggers and impacts, reinforcing our upcoming TaxIQ suite, which supports advanced tax management strategies like gains deferral and tax loss harvesting.

Previously, an implicit drift tolerance of 0% was always applied, which aimed to bring every model and security exactly to its target weight. With this update, we are not only making this setting explicit but also allowing you to modify it, enhancing both visibility and flexibility in managing your investment strategies.

Our integration with StratiFi is now live

We are excited to announce that our integration with StratiFi, a leading platform in risk management, is officially live. StratiFi is renowned for its comprehensive capabilities in portfolio risk analysis, client risk profiling, and compliance support. This new collaboration enables Altruist advisors to import positions, accounts, and client data with StratiFi, facilitating enhanced risk analysis and management across client portfolios.

Leveraging StratiFi’s innovative tools, advisors can now address risk assessment and regulatory compliance more effectively. The platform allows for the development of strategies that are aligned with client risk profiles, thereby optimizing portfolio performance.

Our partnership with StratiFi demonstrates our ongoing commitment to building an open platform that helps independent advisors simplify and streamline critical business workflows–in this case risk management and compliance tools.

StratiFi CEO, Akhil Lodha, stated, “Our strategic partnership with Altruist is set to transform how wealth managers tackle challenges, drive innovation, and achieve growth. Together, we are poised to offer enhanced support to advisors in managing risks and adhering to regulations.”

Setting Up the Integration is simple:

- Log on to StratiFi and navigate to the Integrations section.

- Find Altruist and click the blue Connect button.

- Choose the data you wish to import from Altruist to StratiFi and confirm by clicking Connect.

- A logon pop-up for Altruist will appear. Enter your credentials and click Log in.

- Upon successful logon, you will receive a notification from StratiFi confirming the integration and providing an estimated timeline for data synchronization.

Evestia joins our Model Marketplace

Evestia offers advisors sophisticated SMAs customized to match their clients’ specific risk profiles. Each SMA comprises a diversified portfolio of high-quality individual stocks from around the world, selected through a systematic process grounded in decades of research. Two of their SMA series have joined the Altruist Model Marketplace this month.

- Target Risk SMA Series - Access pre-packaged solutions tailored to match the risk profiles of your clients. Each solution combines 50 high-quality global stocks with low-cost, diversified bond ETFs, precisely targeting suitable risk levels. Designed for advisors seeking the efficiency of ready-made solutions.

- Equity SMA Series - Access institutional-grade individual stock SMAs across nine US style boxes, globally or internationally, featuring portfolios of 20-50 high-quality companies. Designed for advisors seeking building blocks to craft their own customized solutions.

The Evestia SMA Series are available on the Altruist Model Marketplace between 30-35 bps / year.

Disable ACH withdrawals for clients

We’ve introduced a new optional permission setting at the firm level. If you have an Owner or Admin role assignment, you can now prevent your clients from processing ACH withdrawals on Altruist.

Many advisors have requested tighter controls to ensure clients discuss account liquidations before proceeding, ensuring any withdrawals are aligned with their financial plans. This new permissioning setting provides you with greater control over your clients' actions on Altruist.

Default setting and how to change it

By default, ACH withdrawals are enabled for clients. To disable this feature, follow these steps:

- Tap your avatar in the top right corner of your advisor portal.

- Select Settings from the drop-down menu.

- Click on Client Permissions.

- Place a checkmark next to Disable Withdrawals.

What your clients will see

Once withdrawals are disabled, your clients will no longer see the “Withdraw” button when they attempt to transfer funds. Instead, they’ll be prompted to contact their advisor if they wish to make a withdrawal.

This permission setting is available only to Owners and Admins and can be applied only at the firm level, not at the individual account or client level. It also only impacts ACH withdrawals, and not deposits.

Other UX improvements you might have missed this month…

Slimmer notification cards on mobile: We are excited to introduce slimmer notification cards for your clients accessing Altruist on mobile devices. Now, notifications for actions such as transfers, move money authorizations, or new accounts will appear in a shortened format. This enhancement ensures that the actions your clients need to take are more prominently highlighted. Previously, the height of our notification cards could push down important information like account balances. With this update, we have improved the visibility of key account details, making it easier for your clients to stay informed and take necessary actions promptly.

More data added to the Accounts report. Have you checked our new Accounts reports? They’re jam packed with account and client data that you can run and download to streamline administrative and compliance reporting. Altruist is grounded in the principle that your data belongs to you. This month, we’ve added account status and closed dates as new fields with more to come this year. Simply click on your avatar at the top right corner of the Altruist platform and select "Reports" from the dropdown menu to access the Accounts Report feature.