Automate tax management with TaxIQ

Automate tax management with TaxIQ

We’re excited to announce the launch of TaxIQ, a dynamic new suite of tools designed to enhance tax management strategies for a wider range of clients through their advisor on Altruist. TaxIQ integrates seamlessly with our native rebalancer, offering a fully automated platform with customizable settings tailored to individual client needs.

At the heart of TaxIQ is our flagship tool, tax-loss harvesting. This strategy involves selling investments at a loss to offset capital gains during rebalancing, potentially reducing overall tax liabilities. Any remaining losses may offset up to $3,000 of taxable income annually and can be carried forward to future tax years.

Having a tax management strategy may be especially important if you have clients who:

- Are in high tax brackets,

- Possess portfolios with embedded gains,

- Have inherited or wish to pass on legacy portfolios.

IRS reports indicate that the average American allocates about a third of their lifetime earnings to taxes. While taxes are unavoidable, TaxIQ offers a strategic advantage in reducing your clients' lifetime tax burden.

Discover more about how TaxIQ can benefit your practice here.

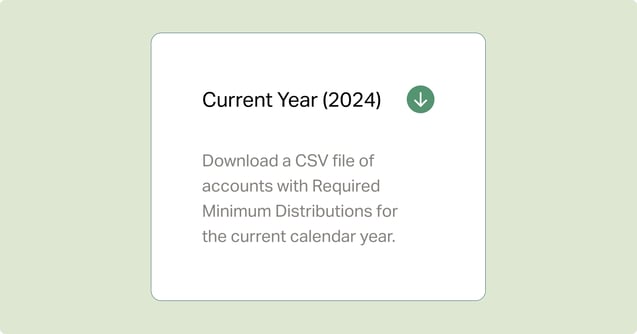

Our RMD Report has been updated for 2024

With RMD report, you can download a convenient CSV file containing a comprehensive list of your client accounts eligible for RMDs for 2024. The report includes critical data such as total RMD amount, amount taken YTD, and remaining balance.

To view the report, log in to Altruist and select your avatar in the top right corner. Select Reports from the dropdown menu. You’ll find a number of helpful reports to unlock the power of your firms data. The RMD report is located under Firm.

We know how important it is to ensure your clients take distributions on time and avoid additional federal taxes for not taking the minimum necessary. We are committed to bringing even more features to help you manage and plan for RMDs more efficiently on Altruist in the future.

Invesco expands their offer on Model Marketplace

Invesco expands their offer on Model Marketplace

Longtime Altruist Model Marketplace provider Invesco is expanding their lineup with portfolios that provide customized bond ladders tailored to specific maturity profiles, risk preferences, and investment goals. These model portfolios are designed to be flexible, convenient and cost-effective.

- BulletShares Corporate Series - Offers investors a cost-effective and convenient approach to corporate bond laddering without the burden of ladder maintenance. These portfolios can complement an existing allocation or act as a stand-alone corporate bond allocation.

- BulletShares Municipal Series - Offers investors a cost-effective and convenient approach to municipal bond laddering without the burden of ladder maintenance. These portfolios can complement an existing allocation or act as a stand-alone municipal bond allocation.

The new Invesco Series are available on the Altruist Model Marketplace between 12 bps / year.

Altruist LLC (“Altruist”) offers registered investment advisers (“Advisors”) using the Altruist platform a suite of tax management tools (“TaxIQ Tools”) including Tax Sensitivity which Advisors can use to provide tax management services to their clients. The Altruist TaxIQ Tools are intended for Advisor use only and Advisors are solely responsible for determining the tax management services they deem appropriate for their clients.

Tax laws and regulations are complex and subject to change, which can materially impact investment results. Altruist believes the information provided herein is accurate but does not guarantee that the information herein is accurate, complete, or timely. Altruist makes no warranties with regard to such information or results obtained by its use, and disclaims any liability arising out of your use of, or any tax position taken in reliance on, such information. Advisors are solely responsible for monitoring client accounts to ensure rebalancer and TaxIQ Tools and settings are operating as intended. Neither Altruist nor its affiliates provide tax or legal advice or discretionary management of customer accounts. Customers are encouraged to consult their attorney, tax professional and/or investment advisor regarding their individual circumstance. Review the “Altruist TaxIQ Tools and Rebalancer Disclosures” on altruist.com/legal for more information.