Introducing Retirement Trust accounts

Introducing Retirement Trust accounts

We are thrilled to unveil the latest addition to Altruist's account options: Retirement Trust accounts. Designed for advisors, this new feature simplifies the management of both prototype and non-prototype retirement plans, such as 401(k)s, Defined Benefit/Pension plans, Profit Sharing plans, 403(b)7s, and 457s, through a specialized "trust" account format.

Opening a Retirement Trust account requires specific information, including:

- Plan trustee

- Plan name

- Effective date of the plan

- Plan tax identification number

- Plan sponsor name

- Account asset ownership (options include multiple participants or single participant)

- Participant name

- Plan type selection (options include 401(k), Profit Sharing, Defined Benefit/Pension, 403(b)7, 457)

- Upload a signed copy of the plan agreement

The plan trustee, designated in the plan documents, plays a crucial role in making decisions that benefit the plan participants. In single-participant plans, this role may be held by the end client or another designated individual. Please note that only the plan trustee will have access to the Altruist Client Portal.

Collaboration with third-party administrators:

To ensure the retirement account is managed effectively, advisors and their clients must collaborate with a third-party administrator (e.g., mysolo401k.net, Lively). These administrators are instrumental in managing the account according to the plan, including monitoring contribution limits and, for accounts with assets over $250K, providing necessary account statements for year-end 5500 reporting.

The third-party administrator also handles all record-keeping, tax reporting, and tax withholding requirements, ensuring compliance and efficiency in managing the Retirement Trust account. You can also enroll your third-party administrator to receive duplicate statements and confirmations by contacting our support team.

Our commitment to enhancing the diversity of account types available to RIAs remains strong. With the addition of Retirement Trust accounts, Altruist now boasts 30 unique account types, and we're excited about introducing even more options later this year.

For more information on how to leverage Retirement Trust accounts for your clients, please visit our Help Center article.

Check out our new integration with ByAllAccounts

Check out our new integration with ByAllAccounts

ByAllAccounts specializes in supporting holistic wealth management through data aggregation and enrichment. It serves as a comprehensive wealth data aggregator, providing seamless access to over 15,000 data sources. This allows for the integration of investor held-away and advisor book of business accounts, ensuring the delivery of top-tier wealth data. ByAllAccounts is integrated into leading wealth technology and performance reporting platforms, including Morningstar Office.

This integration equips advisors leveraging Altruist and ByAllAccounts and Morningstar Office with sophisticated, digital-first custody solutions alongside deep investment data and analytics, paving the way for exceptional investor results. By enabling the ByAllAccounts connection through Altruist, advisors can export their daily Altruist account, position, and transaction data into various wealth applications, including Morningstar Office, Tamarac, and Elements.

Connecting with ByAllAccounts through Altruist is simple by following the steps in our announcement article.

Markin Asset Management joins our Model Marketplace

Markin Asset Management joins our Model Marketplace

Markin Asset Management’s Multi-Asset Series are designed to systematically identify evolving opportunities and translate these insights into the continual management of exposures and appropriately diversified portfolios that seek greater return with less risk.

Markin’s repeatable, data-intensive approach to capital protection and alpha capture facilitates reliable portfolio characteristics that help RIAs make better, more informed, long-term allocation decisions on behalf of investors.

The Markin Asset Management Multi-Asset Series are available on the Altruist Model Marketplace at 87 bps / year.

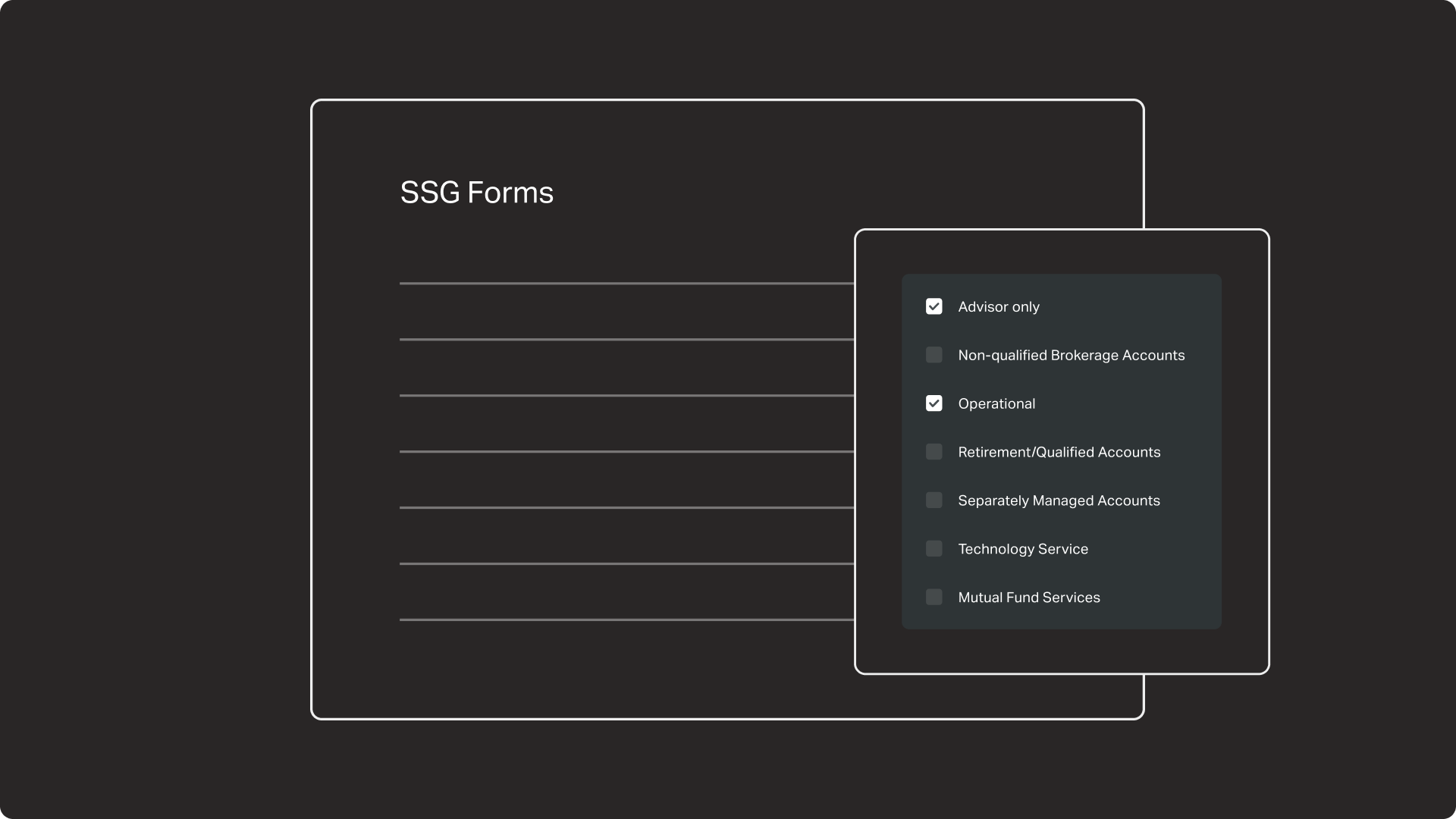

Quick access to essential forms for SSG advisors on Altruist

Quick access to essential forms for SSG advisors on Altruist

This one is for new SSG advisors on Altruist. We’ve integrated the highly utilized SSG Valet forms directly into Altruist. We hope this integration eliminates the need for multiple logins and streamlines your workflows.

Here’s how you can access the forms on Altruist:

- Log in to your Altruist account.

- Click on your avatar at the top right corner to open the drop-down menu.

- Select "SSG Forms" from the menu.

The SSG Forms table can be easily sorted by name, category, and date of last update–along with a simple download.

The SSG Forms section is designed for efficiency, allowing you to sort by name, category, or date of last update effortlessly. Additionally, we've introduced advanced filtering options to help you quickly navigate through common categories such as mutual fund services, operational forms, SMAs, retirement accounts, and more. Plus, our new smart search feature enables you to locate forms instantly by name.

And when you're ready to submit your SSG or Pershing forms, you'll follow the same process you currently use with the SSG Service Team.

Please note, this new feature is the home for all SSG and Pershing Forms previously accessed on SSG Valet. Altruist Clearing operational forms continue to be located in our Forms Library.

Other UX improvements you might have missed this month…

Enhanced fund transfer accessibility. We've improved the visibility and accessibility of the "Transfer funds" feature for households, based on valuable feedback from advisors. Recognizing that the previous placement within individual accounts made it challenging to locate, we've now prominently positioned the "Transfer funds" button on the Household page, adjacent to the "Trade" button. This change streamlines the process of initiating ACATs, deposits, or withdrawals, directly enhancing user experience. Please note, executing fund transfers still necessitates a Move Money Authorization.

Improved custom model portfolio search. We've enhanced the Models page with the addition of two new filters, streamlining the process of locating models that feature a particular ticker or security type. With our intelligent search function, you can entering tickers, such as "AAPL" to display only the model portfolios that contain Apple as an example. Additionally, a "Security Type" dropdown menu allows you to refine your search to models within specific categories, including Equities, ETFs, Mutual Funds, and Cash.

Added email alerts for rebalancer suspensions. Last month, we introduced a new in-app reporting system for instances when automated rebalancing is suspended. This month, we’ve added email alerts to the mix as an additional channel to keep you informed immediately when your action is required to lift a suspension. These notifications help you quickly address scenarios like corporate actions, negative balances, and more by ensuring you're always kept in the loop. You can also download a CSV report of affected accounts for quick action after logging into Altruist. You'll automatically be opted into these email alerts, but can opt-out anytime in your Altruist Settings.

Smoother authentication on smaller screens. We've restructured our authentication flows, including login, password creation, password recovery, and identity verification, to offer a better experience for you and your clients on smaller screens.