A strong social media presence can both reinforce your expertise among existing clients who follow you and boost your chances of being top of mind among prospective clients whenever they face an event that could inspire them to chat with a financial advisor.

What does an ideal RIA social media strategy look like?

First, it’s important to assess your time and resources. There are so many platforms out there – each with its own specific nuances and algorithms – and it’s unrealistic to expect to master them all.

Unless you’re ready to sign a hefty marketing contract with an agency (or hire an entire in-house social media team), consider starting small and branching out slowly over time.

If you’ve already established a following on a given platform, begin by leaning into that. You might be surprised by the results you can achieve from focusing on where your strengths naturally lie.

On an episode of The Advisor’s Journey, Thomas Kopelman discussed how his Twitter strategy led to an additional $18,000 in AUM per month. During the conversation, Altruist Head of Community, Dasarte Yarnway, notes that he sees Kopelman’s name every time he opens the Twitter app. Without missing a beat, Kopelman responds, “That’s the goal, man!”

Through a commitment to content creation and consistent engagement, social media is a proven avenue for helping RIAs to reach their goals – whether it be increasing AUM, registering clients for events, getting a crowd for your webinar, or simply establishing yourself as a thought leader among your peers.

Of course, social media strategy is not a one-size-fits-all product. No two platforms are alike, and each requires its own unique approach and strategy.

Read on to learn what platforms to explore and how best to start growing your business with social.

Organic vs. paid social marketing

The biggest advantage of organic social posts is also the most obvious: the only cost incurred is the time you spend making them.

Organic social media is excellent for establishing yourself as a thought leader, engaging with your existing community, connecting with other advisors, and sharing educational content. When done well, organic social fosters trust and engagement. By its very nature, though, your reach will be limited.

Paid social, on the other hand, involves investing marketing dollars to promote your content – typically generating it directly in people’s feeds. Paid social ads can vastly boost your brand’s visibility, allow you to target audiences with granularity, and include the ability to measure the results your advertising strategies are producing easily.

So, which format is better? That depends on many factors, including your goals and your marketing budget.uis autem vel eum iure reprehenderit qui in ea voluptate velit esse quam nihil molestiae consequatur, vel illum qui dolorem eum fugiat quo voluptas nulla pariaturet risus.

How financial advisors should approach paid social marketing

RIAs may decide to invest in paid social marketing if they want to expand their reach quickly, generate more leads, or promote specific services or events.

Most social platforms have advertising capabilities, so advisors must decide what areas they want to allocate their paid social budget.

Meta boasts the world’s largest social media advertising platform – a marketing universe that covers both Facebook and Instagram – so it’s no surprise that’s where many advisors first test out advertising their services.

The remainder of this post will highlight organic content strategies for financial advisors across the top social platforms. However, if you’d like to learn more about how RIAs can leverage Facebook advertising to grow their business, please check out our in-depth Facebook marketing guide for financial advisors.

The power of cross-posting

Content creation can be a time-intensive process, which makes cross-posting your content across multiple platforms an incredible way to boost efficiency.

For instance, longer-form videos such as recordings of webinars, podcasts, or Q&A sessions can be repurposed for a variety of platforms such as Instagram, Facebook, Twitter, YouTube, and TikTok.

By slicing up video content into shorter, engaging clips, RIAs can make their ideas more approachable for the audience on platforms that prefer that format, maximizing visibility and impact.

Another example of cross-posting in action: adapting blog posts or articles into bite-sized social media captions or infographics, catering to different platforms’ preferences and attention spans.

Cross-posting saves time and energy, allowing RIAs to maintain a consistent presence across multiple platforms without having to create content entirely from scratch.

Which social media platforms should RIAs focus on?

Let’s walk through the strengths of the most popular social platforms and tips on how to get the most out of them.

LinkedIn is indispensable for building professional connections, generating referrals, and publishing industry insights. With over 134 million daily active users, LinkedIn’s high concentration of professionals makes it an excellent space to establish your brand and market your content.

If you don’t feel ready to pen your own pieces, sharing the work of others is a great way to show anyone browsing your page the type of content you read, and what you value, and demonstrate that you’re tuned in to the key developments in your industry.

To read more about how LinkedIn can fit into your social media strategy, visit our guide to LinkedIn marketing for financial advisors.

Twitter/X

Don’t accept the myth that only LinkedIn is for clients and Twitter/X is only for networking. As Thomas Kopelman notes in The Advisor Journey, the audience on Twitter/X can be more open to learning, exploring, and listening.

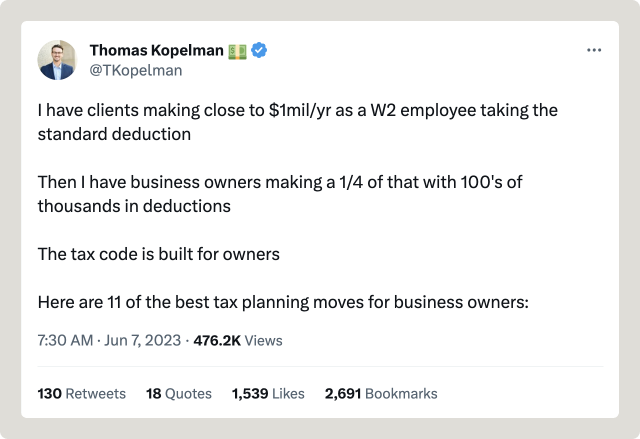

Here’s an example of Kopelman engaging his audience with relevant insights:

-

Share industry news and updates

One way to increase your brand visibility is by engaging with other parts of the industry. By making financial advising all you talk about, followers will begin to see you as an expert in the field. -

Engage and reply

Twitter is perfect for casual conversations and quick replies. Demonstrate a genuine interest in your client’s concerns by replying to questions, sharing your two cents, and asking for feedback. If you want to double down on this strategy, Twitter also has tools for running polls. -

Post often

Social media is not just a quality game, says Kopelman. Twitter lets you play the quantity game, too. It’s common and encouraged to post frequently, and the algorithm often prioritizes new content over day-old content. -

Reap the rewards

By utilizing these tactics, Kopelman says, when a potential client’s business hits an inflection point, they’ll be less likely to respond to the random RIA in their DMs sharing a generic ad for their services – and more inclined to reach out to you.

Kopelman adopts the thought process of a prospective client: “‘He’s given me a ton for free, he knows his stuff, and I know he can solve this problem. Great. I’m gonna reach out to Thomas! They’re gonna want to work with me because I’m the advisor who hasn’t been trying to sell to them but has been educating them all along.”

In addition to its advertising capabilities, Facebook remains the largest organic social media platform in the world, with nearly 3 billion monthly users around the globe (and 239 million in the U.S.). So, how can advisors capitalize on this massive audience?

-

Join Facebook Groups

Finding ways to connect with your ideal potential clients in such a big pond can be tricky. One strategy advisors use is to narrow down the audience by joining Facebook groups relevant to their areas of expertise.

Demonstrating your knowledge to a highly-engaged cadre of people can meaningfully expand your reach and generate more leads than just posting content for your existing followers. -

Host live sessions and webinars

Facebook provides an interactive platform for RIAs to connect with their audience in real-time via live video. Take advantage of this feature by hosting webinars and soliciting questions. This type of back-and-forth fosters engagement builds trust, and can help position you as an expert in your field. -

Use Facebook Insights to track your performance

The Facebook Insights tool provides valuable analytics and performance metrics for RIAs to assess the effectiveness of their Facebook marketing efforts. Analyze your post reach, engagement, audience demographics, and more so that you can gain visibility into your content performance and make data-driven decisions as you hone your social strategy.

Although not the most conventional platform for RIAs, Instagram may still have a role to play in your social strategy. If you’ve elected to use Instagram as part of your social media marketing strategy, here are some ways to capitalize on this platform’s unique features:

-

Create visually appealing content and graphics

Charts and graphs that share financial advice and market insights are a great way to use Instagram’s visually-forward platform to establish yourself as a relatable expert, increase engagement, and grow brand recognition.

With tools like Canva, making eye-catching infographics, charts, and aesthetically-pleasing slides for use on platforms like Instagram has never been easier. -

Utilize Instagram Stories for engagement

Leverage Instagram Stories with features like polls, questions, and interactive stickers. These tools can help you engage directly with your audience, gather feedback, and provide content in a casual and more temporary format (as opposed to the content shared on your primary grid).

YouTube

Given how much attention short-form video has received on other platforms, YouTube might not be the first platform you think of when developing your social strategy. However, financial advisors like James Conole of Root Financial have built tremendously successful online marketing funnels by harnessing the power of longer-form video on YouTube.

On the advice of a friend, James filmed himself recording a podcast and posted the clips to YouTube. It took a few months to connect with the right audience, but when he did, he started to generate a lot of buzz.

“I decided I needed to go all in on this,” he explained in an episode of The Advisor Journey. From inception, his YouTube videos have amassed over 260,000 views, and have played a direct role in a $220 million growth in AUM

For advisors that are planning to start a YouTube channel, James suggests focusing on educating your audience versus pushing sales.

“You’re there to educate, teach, and provide quality content,” he advises. “Do it regularly,” he adds, noting that his “secret sauce” is simply action. Try things out, get things done, and reap the benefits.

Another valuable piece of advice from Conole: incorporate a screening process into your onboarding flow so that when you attract leads from your content, you have a firm idea of how they align with your business goals.

What about TikTok?

The buzz around short-form video is there for a reason: TikTok is the fastest growing social media platform in history, reaching one billion users in just four years (half the time it took Facebook and Instagram).

So, is there an opportunity for financial advisors on TikTok? That may depend on your brand’s style – and your firm’s risk tolerance.

An RIA might look to TikTok to try to reach a younger audience, share engaging clips from longer-form videos, or exercise their creative side by making original content.

On the other hand, a financial advisor might want to avoid TikTok due to regulatory or compliance challenges, the hit they might take on brand perception and professionalism, or for the sheer time and resource investment it takes to create a large library of content.

Conclusion

Regardless of the platform(s) you choose, remember to follow the basic best practices around social engagement: stay responsive, adaptable, and post consistently and authentically.

Allow yourself to be patient as you establish your brand. Growing an impactful social media presence takes time, but these efforts can pay serious dividends down the road.

To learn more about social media and digital marketing, click here.